...and how to avoid them

To excel as an entrepreneur, a good business idea in the current market environment, business activities and company management are crucial for success in business. Successful company management also requires management of the financial side of business. Cash flow management consists of monitoring, controlling, making decisions and smart use of company finances. Despite the importance of financial management, cash flow is often perceived as an imaginary black box of business.

If you want to actively manage your company and obtain positive results, strive to transform the mentioned black box into a so-called white box, i.e. financial management that you have firmly in your hands and are fully in control of. To make the process of clarifying the unknown in the area of cash flow as easy as possible, we have selected the 10 most common mistakes in cash flow management you should avoid if you want to be a truly successful entrepreneur.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

💾 Download this article as an e-book: 10 most common mistakes in cash flow management (e-book)

Mistake #1 You are not monitoring cash flows

Many entrepreneurs believe that financial management of a company involves managing a company bank account, a monthly check of the income statement and keeping an eye on tax liability. They have heard about cash flow management, but they don’t know exactly how to do it. You are not alone in this! Really successful entrepreneurs pay a lot of attention to monitoring their cash flows. Thanks to a cash flow overview, they know how they are doing financially. This will enable them to make quality managerial decisions.

Many entrepreneurs believe that financial management of a company involves managing a company bank account, a monthly check of the income statement and keeping an eye on tax liability. They have heard about cash flow management, but they don’t know exactly how to do it. You are not alone in this! Really successful entrepreneurs pay a lot of attention to monitoring their cash flows. Thanks to a cash flow overview, they know how they are doing financially. This will enable them to make quality managerial decisions.

Ignorance of future incomes and expenses is very unpleasant and economically disadvantageous. If you don’t keep track of finances, you don’t manage them and you can hardly be prepared for the future. The first step is to get an overview of incomes and expenses divided into expected and planned, but less likely ones. Cash flow planning will also make it easier for you to break down incomes and expenses into recurring and one-time payments. It is important to really write everything down.

In case of expenses, pay attention to those that have a long-term impact, such as furnishing and purchasing a car, as well as those that are related to the normal operation of your business. Such include rents, telephones, electricity, heat, water and internet connection charges, office supplies. If you have co-workers, don’t forget to also include the expected payroll and bonus expenses in your cash flow plan.

The other side of the cash flow overview are incomes. Unfortunately, these cannot usually be determined as reliably as expenses. Nevertheless, try to estimate the number of customers in each month and the products you sell in those months as accurately as possible. You may have other than standard income from regular sales. These may be rewards for sales provided by the original manufacturer or ancillary incomes, for example from the rental of part of unused facilities. Include everything in your cash flow plan.

💡 If you are not monitoring cash flow, start with it.

Mistake #2 You are confusing profit with the money you make

In business, much attention is paid to profit, although without the ability to pay liabilities to suppliers and wages to employees, companies go bankrupt long before the final economic result appears in the income statement at the end of the year. You will find valuable information for the analysis of business efficiency in the income statement. Unfortunately, it says little about whether you really make money.

Nevertheless, most entrepreneurs make this mistake and focus only on profit. Are you one of them too? Maybe you’ve already thought of it. The accounting concept of economic result actually differs from the economic category of cash flow. Profit or loss is an expression of the difference between costs and revenues. Cash flow is the difference between cash incomes and expenses. Expenses do not represent 100% of costs, just as revenues more than often do not mean immediate collection of money.

The plus entry in the income statement is entered as of the date of taxable supply on the issued invoice. But money can come to you with a more or less significant time lag. Similarly, a cost in the accounts does not necessarily mean immediate payment. For example, wages for the month of December are part of the economic result of a given year, however, the payment (and thus a reduction in cash flow) will not occur until January of the following year. In case of the acquisition of office equipment, computers, production lines, cars and buildings, the time lag is even more pronounced due to depreciation spread over several years, even though you already paid for the new assets a long time ago.

Costs and expenses, revenues and incomes can thus differ diametrically in real life and in the economic result. The cash flow overview tells you how much money is flowing out of the company and how much money is notionally flowing into the company. You can agree on a later payment with customers, while you already paid for your deliveries a long time ago. You don’t have the money, even though you are profitable. The mismatch between incomes and expenses will force you to actively resolve the situation before you obtain an income statement from the accounts.

💡 Focus on actual earnings, not just accounting results.

Mistake #3 You don’t have a long-term cash flow outlook

Having a good idea of past and current incomes and expenses is a good starting point. But when you don’t see beyond the maturity horizon of issued and received invoices, you are actually looking at a wall. For active management of the company, however, it is necessary to see beyond the wall of the current month. In order to effectively manage your company’s finances, you need to anticipate looming shortages of money before such a situation arises. The effort and time spent planning and managing cash flow is more than worth it.

💡 Have you already tried CAFLOU® - the 100% digital cash flow software ❓

Thanks to a good cash flow plan, you can more easily monitor the payment of received invoices and other liabilities of the company at the time when they need to be paid. You can more effectively plan the development of the company and investments that will not get out of your hand due to lack of funds. Information on sufficient cash flow is also necessary when repaying credits and meeting bank conditions.

Base it on the expected maturity dates of invoices, the payday and the date of rent payments, credit repayments and other expenses. Plan not only the probable development of cash flows, but also their pessimistic variant where not everything goes as planned. In situations where you don’t receive enough orders, the performance of the order is longer than expected, the delivery of material is delayed and that which is available from another supplier is more expensive, you are slowed down by machine downtime, etc., plan to pay only the necessary expenses. Is cash flow still not positive? In advance, you can also think about deferring payments of those business partners who will understand and allow it.

💡 Be prepared and plan your cash flow several months in advance.

Mistake #4 You don’t actively request payment of receivables

When a business is thriving, sales grow. If sales grow, why worry about cash flow? Another common mistake in a company’s financial management is not paying attention to the relationship between sales and incomes. Increasing turnover is putting pressure on operating financing. The company has a higher value of receivables with higher sales volumes. However, if the maturities of receivables contrast with the shorter maturities of liabilities, a problem may arise.

Particularly smaller entrepreneurs supplying companies must be active in collecting their receivables. Smaller companies often do not have penalties for late payments of their customers. It’s similar with setting up processes related to timely payments – they are either set not at all or absolutely minimal. If your business partner does not know for sure that they will hear about you immediately after being late with the payment to you, you can be sure that you will be among the last suppliers that your business partner will try to pay.

It doesn’t matter how big your business is, or how profitable you are, or how many potential business partners are interested in your business. You cannot survive unless you have control over your company’s cash flow. One of the fastest killers of good cash flow are late paying customers. If there is a risk of late payment from a customer, improve your cash flow by regularly monitoring overdue receivables and setting up an automatic reminder system.

💡 Create a system for monitoring timely payments from customers.

Mistake #5 You don’t pay attention to the amount of inventory

A decrease in sales can also cause an increased need for money and therefore has an impact on operating cash flow. Although the amount of working capital will decrease, you will not be able, in most cases, to quickly adjust the amount of inventory to a lower level of sales. It is important to have timely information about the impacts on the development of cash flows caused by changes in sales so that you can propose measures in time, use them to address impending insolvency by stabilizing cash flow and pay your liabilities in time.

Companies that do not monitor inventory levels on a certain day usually do not pay much attention to the turnover ratio of their inventory and the time for which inventory in the company ties up money. These companies miss the opportunity to acquire their inventory in a favourable ratio of the costs of keeping it in stock for too long and the benefit of acquiring it at relatively better prices. Whether you are attracted by a cheaper purchase with a larger volume or a favourable moment of purchase, it is also necessary to monitor, in addition to purchase prices, whether the purchase corresponds to the current need to use inventory in the company.

For the economic success of each company, it is necessary to look for the optimal amount of inventory. The inventory turnover ratio answers the question of how many times the inventory “turns” during the period. Track turnover for individual inventory items, i.e. material, indirect material, work in progress, products and goods according to the assortment. In addition, supplement this performance view with the factor “business ties up resources”. In case of inventory, the criterion of efficiency is the lowest possible value of Inventory Dollar-Days (IDD).

IDD represent a multiple of the value of inventory in the currency and the number of days in stock. This inventory management efficiency indicator answers the question of whether you tie up as little resources as possible in inventory for a smooth production and sales process. The less IDD, the better. The “business ties up resources” factor can express the fact that the sooner you sell inventory that ties up a lot of money, the sooner you get that money back for the company.

💡 Monitor inventory levels and inventory turnover ratio.

Mistake #6 You don’t monitor the financial health of your customers

Are you preparing for several scenarios in your cash flow plan? If your answer is no, for example due to a time burden that you cannot afford, we have information to think about. The time devoted to creating both an optimistic and a pessimistic variant will pay off many times over. A common mistake in cash flow management is not using the savings resulting from the addressed risks, which are associated with key areas of your activity, such as sales volume or purchase price of basic inputs.

Think about the possible risks and look for their root cause. Finding it may be more laborious than just realizing a particular risk. However, if the risk can have serious effects on the company’s wallet, it is worth making a deeper analysis of the causes. For example, you realized the potential threat to the fulfilment of the cash flow plan due to delays in payments of your major customers. What causes such behaviour of your business partners? Try financial analysis.

The analysis of the financial stability and performance of your business partner’s company can be simplified by using a quick test of credit worthiness. It is based on a few figures from the accounting statements. Thanks to the results of the credit worthiness test, you can grade your business partners on a scale of one to five. When planning cash flow, you will then focus mainly on the “fours” and “fives”, i.e. companies potentially unable to pay their debts. The risk of late payments by customers, which are caused by their serious financial problems, represents a high degree of threat to your cash flow. Chance favours the prepared mind. Thanks to the credit worthiness test, you will have an idea of this risk and therefore require, for example, the delivery of goods against an advance payment.

💡 Predict the payment morale of your business partners thanks to the test of credit worthiness.

Mistake #7 You pay your liabilities before they fall due

Liabilities have one essential feature. They have a given maturity. This means that the obligation to perform will occur at a pre-known moment in the future. Some liabilities are short-term, for example liabilities to employees are normally due with a delay of ten to twenty days. Other liabilities may be due over a longer period of time, for example liabilities arising from long-term loans will be repaid by the company over a number of years.

A financially sound company is able to pay its debts when they fall due. It is not right to pay your debts late. However, it is also a common mistake to pay common liabilities early, i.e. before the contractual due date. You may have come across the three principles of every business person – buy cheap, sell at high price and don’t pay immediately.

Working capital is needed to finance the operation. You can derive its amount from the value of money tied up by the inventory of materials, goods and products, receivables due within a year and money in the company’s account and the company’s treasury. These short-term current assets are constantly transformed from money into inventory, from inventory to receivables and from these again into money. The number of days for which inventory and receivables tie up money represents the length of operating financing.

In order to be able to finance working capital from sales, the maturity of liabilities should optimally be equal to the length of operating financing. If you manage to achieve this, your company will finance itself. Conversely, if liabilities are due in less time than you can finance your operations and get money from sales, you will need other sources of financing, such as an operating loan. If you have agreed deadlines for the payment of your liabilities, it doesn’t make economic sense to pay them earlier than when they fall due.

💡 Pay your liabilities only when they are due.

Mistake #8 You don’t distinguish 3 key types of cash flow

When a company ends a financial year with more money in company accounts and the treasury than at the beginning of the year, it made profit. Do you also succumb to this common error in cash flow management? The quick conclusion that getting money is the same as making profit has already ruined many entrepreneurs. The money obtained by a credit will have to be repaid in the future. Deferred investments lead to stagnation of the company. Selling critical technology can put a company at a competitive disadvantage.

And what if you have less money at the end of the year than at the beginning? If the total cash flow is very low or even negative, it is the inability of the company to generate funds. Another quick and not always correct conclusion. It can be different. The company has acquired new assets and is therefore investing. It focuses on more profitable markets, thus optimizing its performance portfolio. Or it repays its current long-term credits and is a solvent partner in the market.

The total cash flow will not tell you whether you are actually making profit, if you have the resources for the investment development of the company and the repayment of your long-term liabilities as well as the payment of profit shares. So how do you avoid this mistake? It is essential to distinguish between cash flow from operating, investing and financing activities. The diagnosis at the level of operating cash flow is much clearer. Operating cash flow should be clearly positive. The company should make profit through the activities because of which it is on the market. The higher the cash flow from the operation, the better the situation for the company. Greater operating cash flow gives the company the freedom and flexibility to build its long-term strategy.

💡 Pay attention to three parts of cash flow for the sustainable development of your company.

Mistake #9 You are not preparing for worse times

Excess expenses together with insufficient financial reserves are one of the most common causes of company bankruptcy. You can address sudden shortages of money by drawing funds from an overdraft. However, the conditions of banks vary from company to company. In addition, the agreed credit limit may not be sufficient to cover the cash flow shortage.

In most cases, there are always some expenses that can be saved on without affecting employees. There may be a number of seemingly smaller expenses, but if they represent a significant share in the total expenses, it is appropriate to revise them in case of insufficient financial situation of the company. The basic equation of liquidity management is this: expenses = incomes + balances of funds. A temporary reduction in costs will not only loosen the straitjacket of your financial crisis, it will also restore profitability.

Active concern for corporate finances and thorough cash flow planning will allow you to prevent possible financial difficulties. In order for a company to succeed in a highly competitive environment and maintain its financial health, it needs to make effective use of all the resources at its disposal, be it human, informational, financial or otherwise. In order for the company’s management to have a realistic idea of whether resources are used efficiently, create company value and contribute to the stable position of the company, it is necessary to use at least one tool for early warning of possible problems. This tool is a cash flow plan.

💡 Actively engage in financial management.

Mistake #10 You are not using a smart cash flow management tool

Do you already have an idea of the need for a plan and cash flow management, but regular updates of your cash flow burden you and discourage you from working with it? You may not yet concentrate all the necessary inputs into one tool that can work effectively with them and make the use of your cash flow plan much easier. However, reliable cash flow planning is a source of competitive advantage.

With the help of technologies, you can simplify many things in the company, from invoicing, through customer support, sharing documents with colleagues and increasing the overall efficiency of company activities. A good information system will do a lot of work for you. However, it is necessary to plan not only the real development of cash flows, but also an estimate based on possible developments. A division of the outlook into realistic, which includes only invoiced activities of the company, and probable on the basis of incomes from regularly invoiced activities that are yet to be invoiced, or future already known ad hoc orders, could be good for your orientation.

Appropriate cash flow management and planning software makes it easier to work with variant planning, as they can record potential sales according to the probability of their implementation, including the deadline and payment terms, or even incorporate customer payment morale into the cash flow plan based on their payment history.

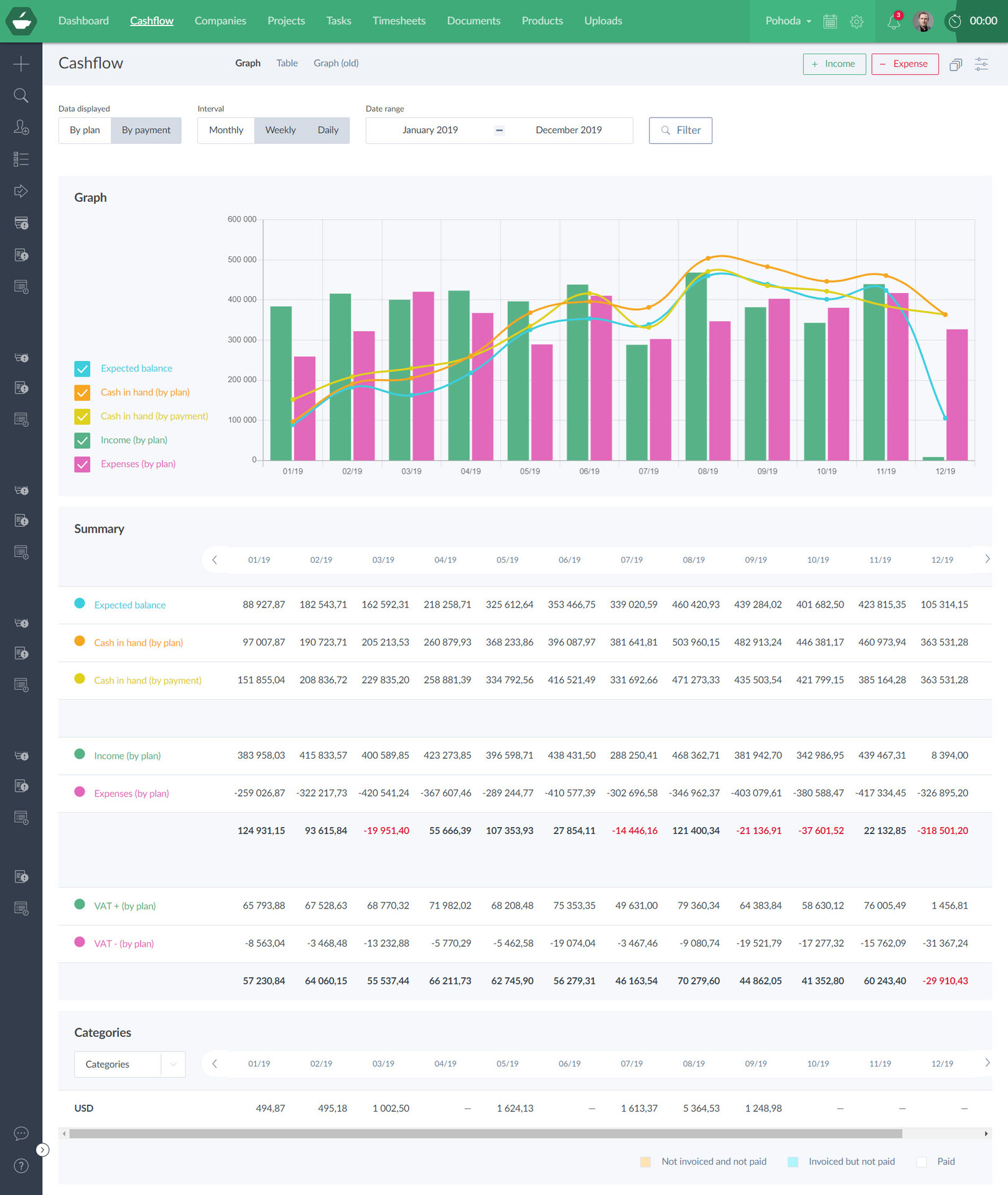

For example, CAFLOU cash flow software allows you to see incomes and expenses by each customer or supplier, by category and also by projects, and at the same time in an overall view of real and estimated cash flows.

💡 Automate your cash flow management with a smart tool.

10 most common mistakes in cash flow management and how to avoid them - SUMMARY:

- You are not monitoring cash flows ->> If you are not monitoring cash flow, start with it.

- You are confusing profit with the money you make ->> Focus on actual earnings, not just accounting results.

- You don’t have a long-term cash flow outlook ->> Be prepared and plan your cash flow several months in advance.

- You don’t actively request payment of receivables ->> Create a system for monitoring timely payments from customers.

- You don’t pay attention to the amount of inventory ->> Monitor inventory levels and inventory turnover ratio.

- You don’t monitor the financial health of your customers ->> Predict the payment morale of your business partners thanks to the test of credit worthiness.

- You pay your liabilities before they fall due ->> Pay your liabilities only when they are due.

- You don’t distinguish 3 key types of cash flow ->> Pay attention to three parts of cash flow for the sustainable development of your company.

- You are not preparing for worse times ->> Actively engage in financial management.

- You are not using a smart cash flow management tool ->> Automate your cash flow management with a smart tool.

💾 Download this article as an e-book: 10 most common mistakes in cash flow management (e-book)

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.