...when it has already struck or is around the corner

Is your business in crisis? Are you deciding how to get out of the crisis? Are you trying to reduce the negative impact of the crisis, but are you running out of ideas? Has the crisis already affected your cash flow and are you afraid of the company going bankrupt? Or do you have an intensive feeling that the crisis is just around the corner and are you looking for ways to prevent its negative impact?

In this very current situation, we offer you a practical guide in the form of an action plan of steps to deal with the crisis.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

💾 Download this article as an e-book: Action plan to handle cash flow in a crisis (e-book)

Step #1 Don’t panic

Many companies are currently facing a tough reality: their sales are declining. Maybe it has happened to you, too. Many of the already arranged contracts have been dropped. New projects are being postponed. Some co-workers are not able to fully participate in the company’s gainful activities due to the COVID-19 disease or the ordered quarantine. Crisis-stricken clients are delaying their payments. Your business is at risk of insolvency. The end of the crisis is not in sight. Who would keep their nerves in such a situation?

In general, crises are usually better endured by those entrepreneurs and investors who have already gone through one. They know that every crisis has an end. You can come out of it stronger or weaker. It’s up to you. In his novel The Wondrous Tale of Alroy, Benjamin Disraeli, a British politician and 19th-century writer, says: “I am prepared for the worst, but hope for the best.” Successful business owners and managers maintain a positive attitude even in unfavourable times and continue to actively manage the company’s cash flow.

Fast action is key to a company’s survival in a period with a lower or even critical cash flow. To keep your business afloat when the income is falling, take action immediately. Rely on the experience of those who keep a cool head and can emerge from crises in better shape than before. If you have only managed cash flow passively so far, it’s high time to actively start with this number one priority.

💡 Take action hoping that it will turn out well.

Step #2 Find out how you are currently doing

Less orders, less work, less money earned. But do you know how you are really doing? Monitor your cash flow, be it in good or bad times. Keep track of incomes and expenses. Map at least the next 6 weeks. If you’ve monitored your cash flow before, embark on a realistic revision of your incomes and expenses. The more real information you have about your current status, the more options how to handle the situation there will be.

Less orders, less work, less money earned. But do you know how you are really doing? Monitor your cash flow, be it in good or bad times. Keep track of incomes and expenses. Map at least the next 6 weeks. If you’ve monitored your cash flow before, embark on a realistic revision of your incomes and expenses. The more real information you have about your current status, the more options how to handle the situation there will be.

💡 Have you already tried CAFLOU® - the 100% digital cash flow software ❓

First, focus on the income side of your business. What incomes can you expect in the near future? What are the maturity dates of current projects? What is the probability of maintaining repeatable incomes in the current situation within the period of weeks? Which of the expected incomes are supported by issued invoices? Which have not yet been invoiced, but are at least declared by contracts? And what part of the planned incomes is based only on business prospects?

Of course, also go through regular expenses, such as payroll, payments to business partners, tax payments, credit and loan instalments. Equally important is their timing. What are the mandatory payment dates? What are the maturities of received invoices? Divide expenses into unavoidable, necessary and those that are desirable, but can potentially be postponed. Include those that directly condition the existence of the company among the unavoidable ones. If you didn’t have the funds to pay for them, it would mean the inability to continue doing business and achieve sales. Consider expenses that are not worth saving on in the long run as necessary in your cash flow. What can your business not do without? What makes your business vulnerable?

The distribution of expenses will help you determine the unavoidable, necessary and desirable level of incomes that will be needed to maintain cash flow in the coming period. So far, reconcile incomes and expenses according to the time of collections and payments, at least “on paper”. Not only will you avoid surprises, but it will allow you to think realistically about how best to handle the situation.

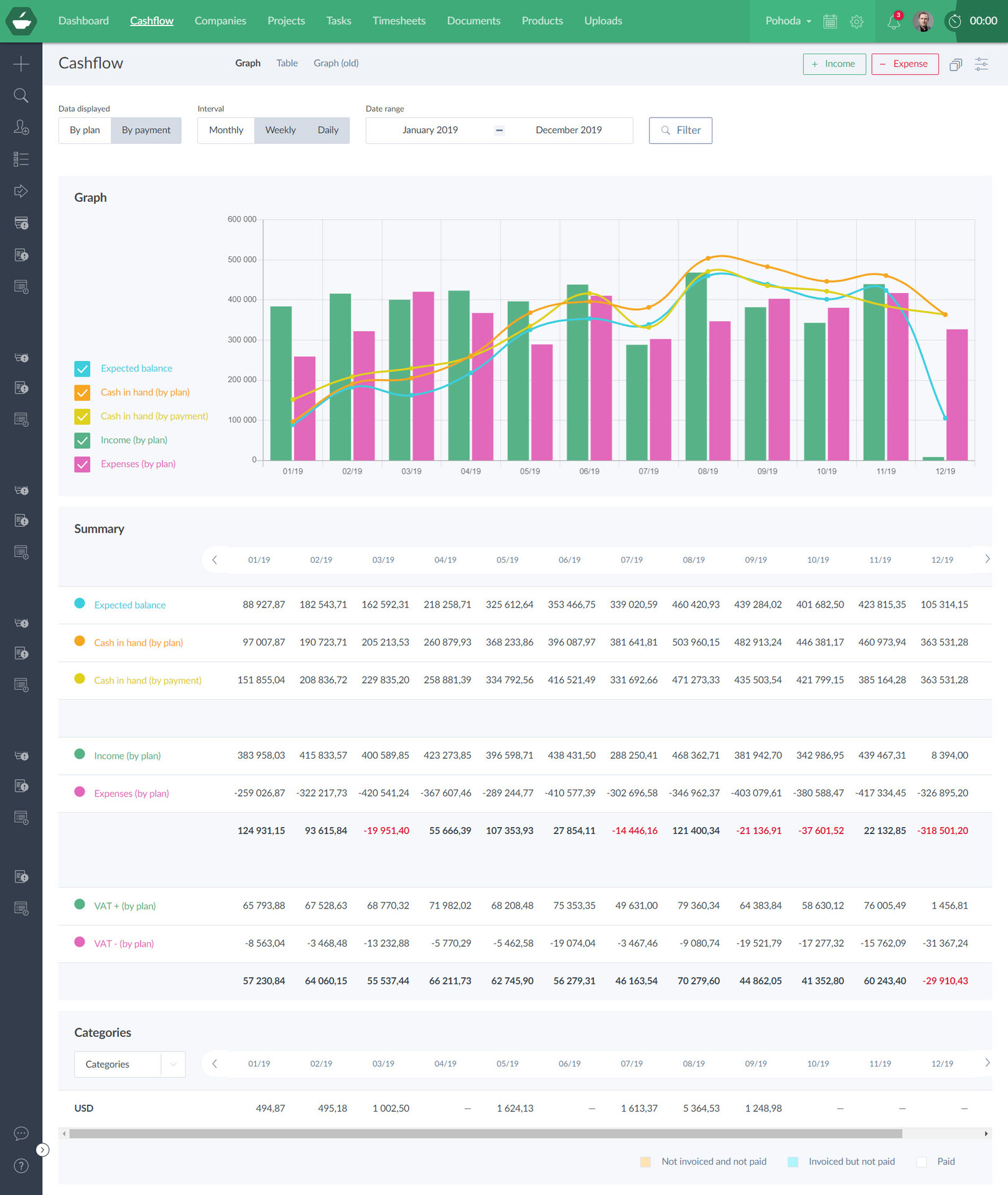

Keep track of what needs to be paid and when it needs to be paid. You can efficiently use software solutions specialized in cash flow management and planning. In addition to the cash flow forecasts, many of these also offer the visualization of the status and development of free cash flow when various parameters are defined, usually not only for the company as a whole, but also by customers, projects or other activities.

💡 Cash flow statements and prospects are key in a crisis.

Step #3 Make internal changes

The golden rule of healthy cash flow is: collect incomes as soon as possible, pay expenses only at the time of maturity. Not all companies will be negatively affected by the crisis. Some companies entered the crisis with a very strong financial condition. New implementation possibilities have opened up for others, and the decline in sales is not the order of the day for them. Some companies are waiting for the situation to develop and are not paying their liabilities in advance as a precaution. What can you do to speed up your incomes? Before your invoices are due, contact your customers and verify that they plan to pay your invoice. Invoice as soon as possible after your work is done. Consider whether invoicing can be split into multiple parts to invoice more often. Work on getting advances. It will also allow your customers to predict their cash flow. If they are late with their payments, remind them saying you understand the situation, but appealing that liabilities need to be paid.

Monitor the creditworthiness of your clients. It will be more important than ever to be aware of the liquidity of your business partners. If their situation does not develop well, be prepared to file your claims in time in case of insolvency proceedings.

Also, don’t underestimate the tactics of your business partners. Anticipate the various possibilities of the impact of managing or not managing the current situation and work out several scenarios for the development of your cash flow. How will income outages affect your cash flow by customer and by payment delay? We don’t deny that the development of cash flow in very uncertain times, when the largest unknown is the income from sales, is difficult to plan. That is why it is appropriate to make variants of the plan so that the company’s management is able to make a qualified decision as to which variant, and with what possible impact, to choose.

You can also do a lot to improve cash flow management by choosing the right accounting procedures and thinking about the appropriateness of setting up internal processes. Internal processes affect the need for working capital. By improving them, you can prevent, for example, funds being unnecessarily tied up in the company’s operations due to chaotic administration of receivables or excess inventories of materials and work in progress that do not correspond to the decline in sales.

Poorly developed production planning also has consequences for cash flow. Therefore, pay attention not only to the actual management of production and production activities of the company, but also to its impact on the economic side of business and the connection with financial management. Start monitoring and evaluating the average liabilities payment time and the average receivables collection time.

Use this unfavourable period to reflect on your processes. What works well and what have we been neglecting? Think about whether you have set conditions that are favourable for your cash flow. Have you invoiced right after finishing your work or waited until the end of the month? Have you pushed for advances or have you always been more lenient with your clients? Have you managed production hand in hand with evaluating the impact on cash flow? Do you work on an automated invoicing and a reminder system? This will prepare you for the time when the crisis is over.

💡 Be prepared for different variants of development even when the crisis ends.

Step #4 Actively support sales

It can’t be helped, you undoubtedly understand your business, but you must also understand your numbers. Which groups of customers do you sell to and what is the associated added value? Maybe some customers are already putting downward pressure on prices. However, in times of tight budgets, providing discounts can be teetering on the edge of the financial gap. You simply need to know if your margins will “stand” the discount. Track margins as the difference between how much you sold your products, goods, or services for, and how much you bought or created them for. When buying and selling goods, it is essential to know what earnings the transaction provided. Business margin is the difference between sales from selling goods and costs of the goods sold. Also evaluate margins in relative terms, i.e. as a ratio expressed as a percentage. By comparing the required discount and your margin, you will be able to better decide whether the price discount is affordable for you.

If you are one of the companies that not only trade, but also produce or provide services, evaluate the value-added margin. You calculate the added value as the difference between sales from selling products, services and goods and costs of the goods sold and the material consumed.

You can determine the value-added margin by the share of the added value and the sales from selling goods, products and services. The value-added margin will then be a good guide for you to which customer segments, or which of your performances, you should now ideally focus on. Also actively support those with the largest margins on the market.

Margins are a guide, but they do not evaluate, for example, the laboriousness of orders. It is therefore important to review the price calculations as well. Do your calculations give you the right numbers? Do you know reliably which part of production costs is fixed, which is variable? What performance do you spend more time on? Can your calculations value the time spent on the order? For example, evaluate your orders using the hourly rate method, which takes into account the laboriousness of the services. In short, it is a procedure where you subtract direct costs from your total costs (usually material or other direct costs of the order, such as commissions to traders) and divide the remaining costs by the number of billable hours. The resulting share represents the rate at which you can value your orders with different time requirements.

Which of the products is worth offering and which is not will also be shown by the contribution margin. This is the difference between the selling price and the variable costs. Variable costs are those that change depending on changes in the volume of performance. Typically, this is the consumption of material, packaging or direct salary. Of course, your costs also include fixed ones. These do not change with the volume of production. Examples may include rental, assistant’s salary, depreciation of fixed assets or, for example, interest on a received bank credit. The current task is to support the sale of those services that contribute to the payment of fixed costs more.

💡 Purposefully increase customers’ interest in services with higher added value.

Step #5 Eliminate only some expenses

Crisis often brings a decline in production. Production needs to be adapted to the temporary reduction in demand and at the same time prepared for further possible growth. Subsidizing production does not make sense in the long run. Do you think that the only solution to the acute shortage of cash flow is spending cuts? Yes and no. It is important to try to maintain what has the potential to bring money to the company. Therefore, limit expenses related to people or repairs and maintenance of production equipment very carefully. Instead, try to strengthen what works. What about investing during a crisis? If you have free resources and you already prepared the acquisition of real estate or technology before the crisis, now is the right time to execute it, given the generally more favourable prices. In particular, the modernization of your operations, which will enable the production of more complex products with higher added value, may be the right tactic for competitive fight.

In times of crisis, employee training is one of the first items on the list of cut expenses. However, reducing the volume of work is a good time to improve professional skills and strengthen professional knowledge. It is important to evaluate the impact of such expenses though.

They should be directed where there is a reasonable expectation that they will pay off for the company in the form of expanded income opportunities. Which employees are key to your business? You will probably want to focus more on those employees who are able to hold other positions and develop further. Constant training communicates expectations of constant improvement. Competent employees are more productive and efficient. If you are forced to reduce the number of regular employees, these will be the key people you will be able to rely on in times of crisis.

Excessive expenses together with insufficient financial reserves are one of the most common causes of company liquidation. So, what to save on without affecting employees or crippling the execution of sales? Go through all monthly expense items. There may be a number of seemingly smaller expenses, but if they represent a significant share in the total expenses, it is appropriate to revise them in case of insufficient financial situation of the company. A temporary reduction in costs will loosen the straitjacket of your financial crisis. And in case of the expenses you find necessary to keep the business running, don’t forget to pay your liabilities when they are due.

If that’s not enough, go through the assets you can use as collateral to obtain additional bank resources. If there is a period during which the adjustment of incomes and expenses is unsustainable, start thinking about what assets you can sell. Whether it’s unused machinery or equipment or excess inventory, sell it if possible. Unnecessary assets tie up money without being of a value to the company. However, if you still need equipment or cars for your business, you can still consider incomes from their sale. Leaseback can be a solution involving a lot of equipment. The offer to obtain immediately usable funds for the sale of your assets, which you continue to use for a fee, comes to those who have a good creditworthiness. So, don’t wait too long. To make it easier to overcome a difficult financial period, you need to act quickly. Similarly, you can actively evaluate the possibility of selling your receivables to factoring or forfaiting companies.

💡 Strengthen what works, cross out the rest.

Step #6 Communicate

What should I do if the company ran out of money? It is essential not to bury your head in the sand at such time. First of all, communicate the situation with your team, with your employees. However, they don’t want to hear unsubstantiated soothing. Your message should be a realistic assurance. If you already have a good idea of the possible development of your cash flow, tell them: “I’m doing this or that, I need X days and we can handle it.” Find out what their concerns are, agree on a possible solution, and if you can, make it easier for them to manage their uncertainty, at least partially.

Also give them scope to comment on ways to streamline day-to-day activities. Pay close attention to their suggestions and transform as many meaningful ideas into common practice as possible. Ask your people what you can do to make them work better in the days to come. This will strengthen not only the company’s economy, but also the loyalty of the employees. According to statistics, engaged employees are more satisfied with their work, and this is reflected in stable performance, increased quality of the performed work, and ultimately in positive cash flow.

Communicate inside and out. When and under what conditions the company will have money is essential information not only for employees, but also for your vendors, business partners, banks and government institutions.

If you have cash flow problems, be proactive and suggest whatever options your situation will allow. Find out how your business partners are doing. It can be assumed that this crisis will change the fortunes, as it fundamentally changes the circumstances of negotiations on discounts and increases in sales prices. Alliances and mutual assistances are likely to emerge across the market. Be there. Take an interest in your circle of business partners. Be flexible in thinking about your business model. You may come up with a solution interesting for multiple parties of the trade.

Don’t forget to actively communicate with your bank. First, review your current credit documents. What are the obligations? What conditions (covenants) did you commit to? If they are unable to be fulfilled due to the current situation, what are the penalties under the contracts? Review basic examples of violations and evaluate whether any of them apply to you. What are the conditions for terminating contracts? Prepare possible security. Make an inventory of assets that you may have to release for the security. Keep your financial plan up to date and review cash flow development variants.

In each variant, focus on the ability to repay your debts. Calculate when the funds are likely to run out. All your preparations will speed up the subsequent negotiations.

If your business is going through times so hard that you have to turn to the state, banks or investors for a solution, your previous preparation will be absolutely crucial to get the help. Although the state proclaims aid, the rules for providing it are ever changing. Whatever the form of help by the state and possibly banks, you can expect a requirement for well-prepared economic documents, including your business, production and financial plans, a reckoning of your losses, proving your ability to repay, but also proving the implementation of your own austerity measures. So, prepare the documents. Follow the development of the situation. Find out about current and future possibilities of getting help. Communicate with your tax advisor, state institutions, banker, or contact an external crisis management specialist.

💡 Be prepared and let all parties involved know that you are actively addressing the situation.

Action plan to handle cash flow in a crisis (when it has already struck or is around the corner) - SUMMARY:

5+1 steps of the action plan to handle cash flow in a crisis

- Don’t panic: Take action hoping that it will turn out well.

- Find out how you are currently doing: Cash flow statements and prospects are key in a crisis.

- Make internal changes: Be prepared for different variants of development even when the crisis ends.

- Actively support sales: Purposefully increase customers’ interest in services with higher added value.

- Eliminate only some expenses: Strengthen what works, cross out the rest.

- Communicate: Be prepared and let all parties involved know that you are actively addressing the situation.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.