The key stone of any business is its financial health. One of the important tools for evaluating the economic side of business is financial analysis. Maybe you use it yourself, and no doubt you have heard of it. We will advise you on how to set basic indicators of economic health and also incorporate cash flow indicators.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

Pillars of good condition of the company

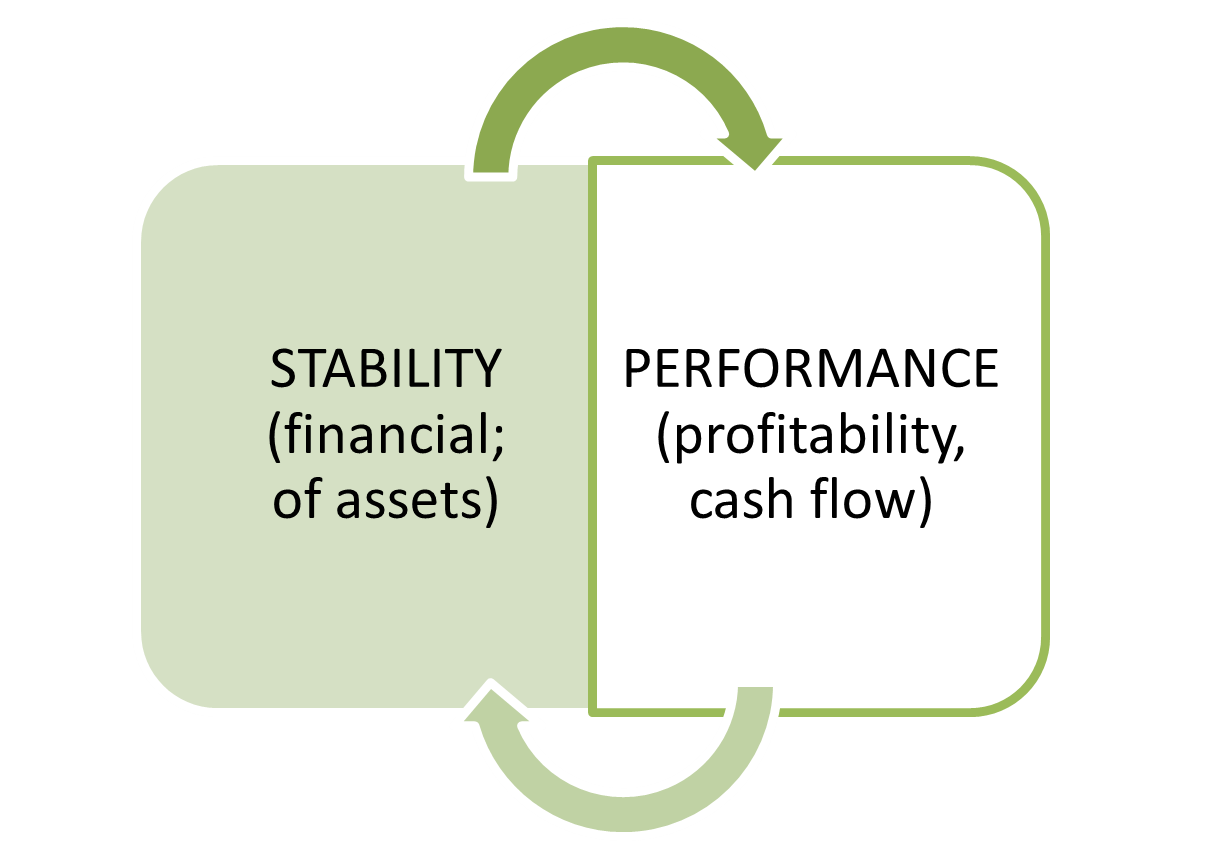

Every business is based on two imaginary economic pillars. A company must offer goods, products, or services that its customers want to buy. The ability not only to offer something, but also to turn it into sales and profits and make money, is a PILLAR OF PERFORMANCE.

The second pillar is STABILITY, both in terms of assets and finances. In short, there is a need to balance income and expenses well. An economically sound company is one that can pay its liabilities when they are due. Thanks to financial resources and assets, the company can achieve its performance. The services provided on the market make funds for debt payment and purchase of more goods, materials, production equipment, etc. The two pillars are thus interconnected.

Characteristics of financial health of a company

If you want to keep track of the economic condition of your company, we recommend that you monitor at least one indicator from the performance pillar and one from the stability pillar. The relationship between own and external resources is a key issue in optimizing the financial structure. What is the optimal ratio? The answer is not quite simple. External money is cheaper than your own. Some indebtedness is desirable because it promotes the return on invested capital. On the other hand, rising debts reduce the company’s financial stability. An indebted company becomes riskier for banks and less suitable for credit granting with good interest rates. In other words, if you do not have debts, you do not bear the risk of their non-payment. If, on the other hand, you want to use external capital, it is advisable to watch the upper limit of the share of debts in total liabilities. In short, debts must not get out of your hand. You can tell if debts have exceeded the tolerable limit by negative equity. This is a strong risk factor that significantly reduces the company’s creditworthiness.

Too much equity, on the other hand, makes it difficult to achieve potentially higher profitability. What to do about it then? The business owner is the last person who can claim something from a failing company in the event of bankruptcy. Precisely because of this risk, it is safer for business owners to hold only as much equity in the company as the value of fixed assets. However, indebtedness only makes sense if you can earn more with additional resources.

So, what about investments? A simple rule proves that the rate of investment growth should not be higher than the rate of sales growth. The rule is based on the logical reasoning that new investments must be paid by the existing ones.

Compare the amount of sales from the main activity (sales of goods, products and services) with the value of net assets (i.e. the amount of your company assets). Did you get a ratio higher than 1? Then this is the optimal situation. By following this rule, it is easier to avoid investments that are not reflected in increased sales.

What is the real effect of doing business?

A group of indicators called profitability deals with business efficiency. In general, it is the ratio between the effect and what the effect is supposed to deliver. For example, the owner is interested in the effect of what was invested into the business. The profit and equity ratio can thus be an indicator of profitability. To compare the performance of two companies, the ratio of profit or cash flow to the amount of managed assets is a suitable relation to monitor.

In relation to sales, it is the profit or cash flow to executed sales. The higher the value, the greater the effect. Because profit and cash flow can have completely different values in a given year, you can distinguish whether your business has an effect in the form of economic result or whether it generates money by choosing one or the other in the above profitability indicators.

We will be happy to help you via our financial analysis training on how to choose the indicators that will really help you direct your business to the desired values.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of