A well-established system for monitoring and evaluating a company’s economy therefore focuses not only on revenues and costs, but also on cash flows or cash flow.

Every entrepreneur wants to have an economically successful company. A lot of attention is paid to profit and income statement. Nevertheless, a company that has a book loss can survive on the market for several years. However, a company that does not make money often goes bankrupt soon after failing to pay its liabilities to suppliers and wages to its employees. In an imaginary duel of money vs profit, money wins.

A well-established system for monitoring and evaluating a company’s economy therefore focuses not only on revenues and costs, but also on cash flows or cash flow.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

Cash flow management is a natural part of financial management of successful companies. However, the good economic situation of the company is primarily the result of people’s actions. It’s about people and not quite about numbers. Financial management is not only in the hands of company economists, who take care of securing a functioning accounting system and creating statutory reports. This also applies to the company’s non-financial managers. The common goal is the meaningful use of financial resources and earnings of the company in fulfilling investment opportunities, connection with the development of wages and the like.

Cash flow versus profit and loss statement

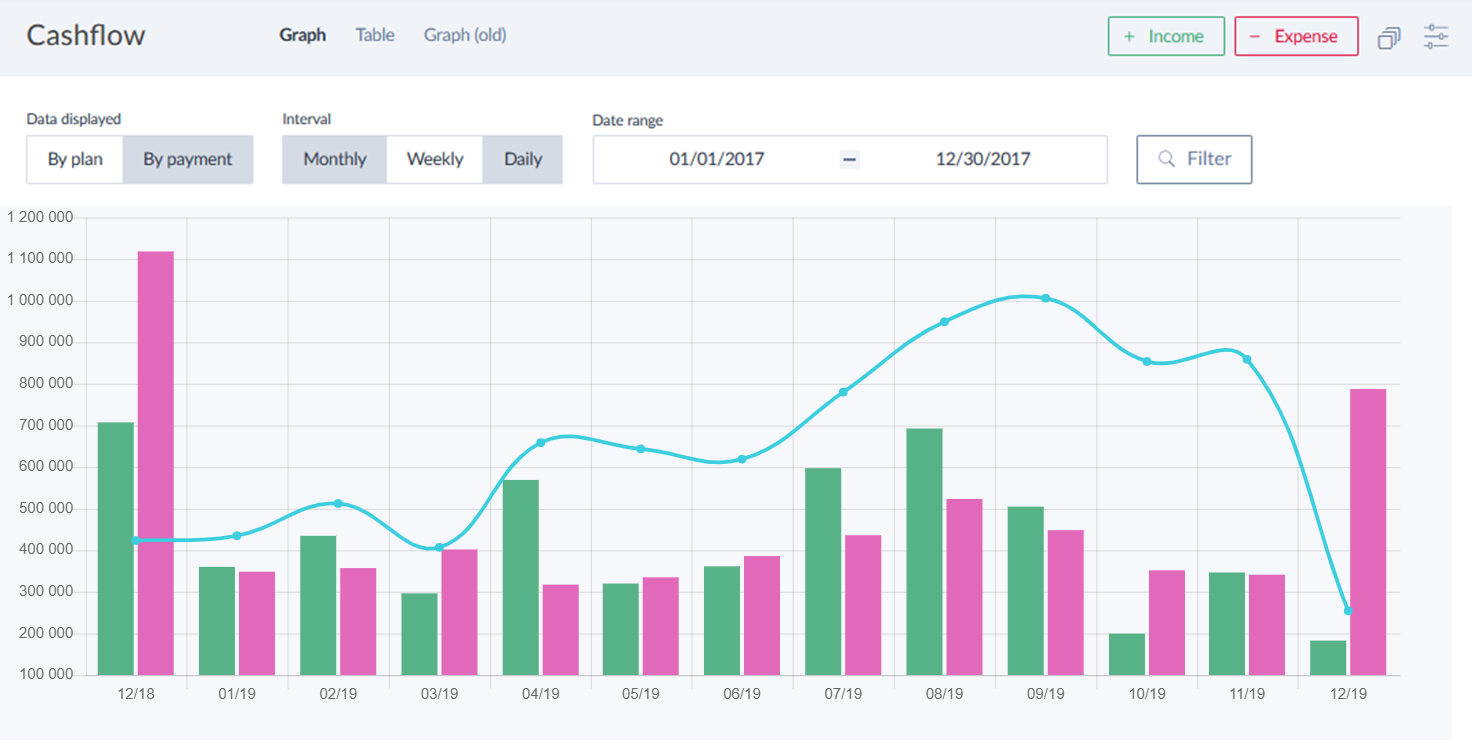

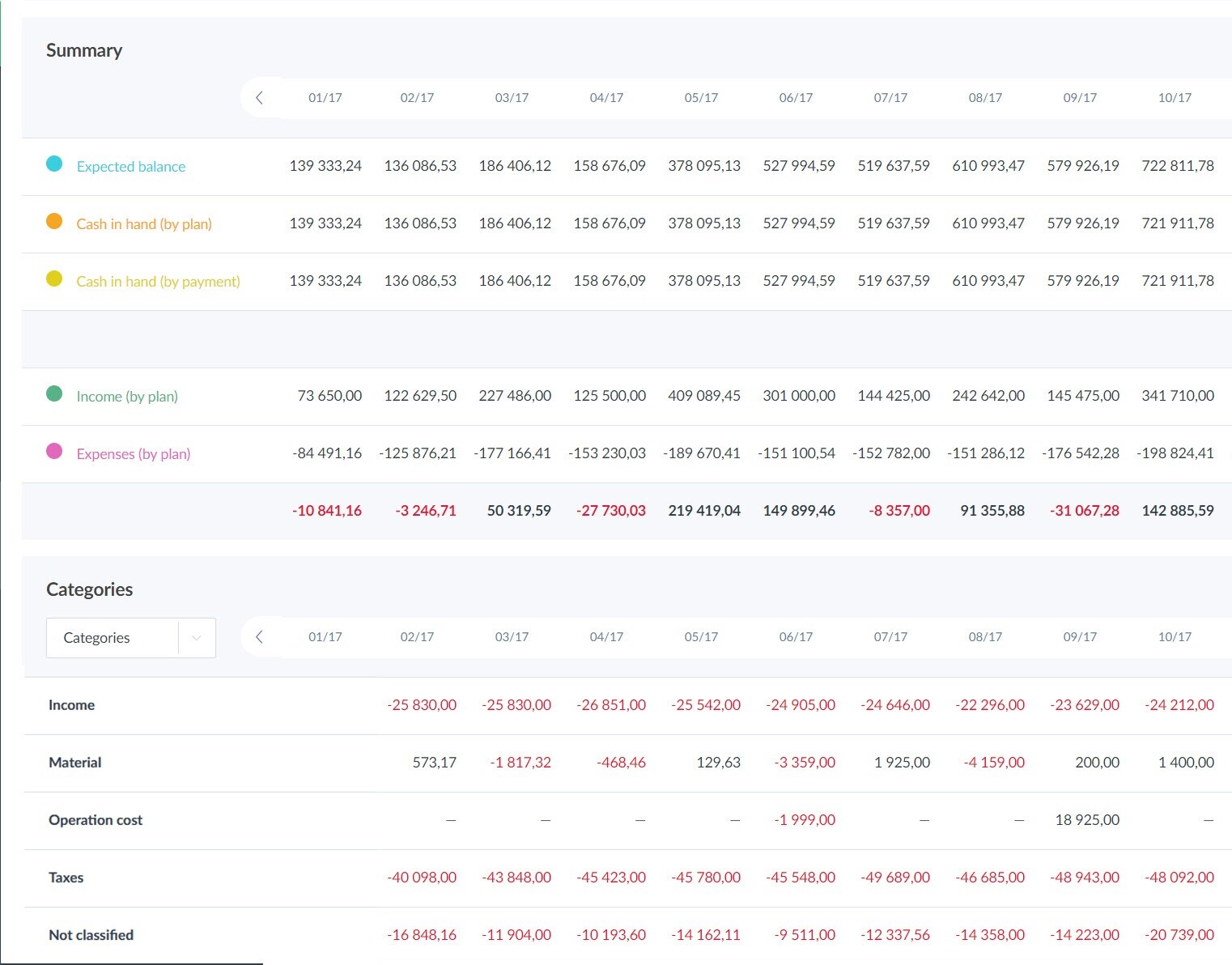

Cash flow clearly complements valuable information about the economic activity of your company. For successful economic management of a company, it is necessary to quantify what brings money to the company and what, on the contrary, the money is spent on.

The profit and loss statement cannot convey this reliably. There are items in it that may not be accompanied by the movement of funds. Such accounting costs that are not an expense of money are, for example, depreciation, adjusting items or the creation of reserves. They therefore affect the economic result, but not the cash flow of the company. In addition, the income statement does not keep an account of the collection of money obtained from a credit or, conversely, the repayment of the principal of a debt, as only paid interests appear among the costs. The cash flow statement will show you whether you really earn money much more accurately and concisely. Thanks to it, you will find out not only whether your company made money, but also which area of its activity made it.

When a company ends a financial year with more money in company accounts and the treasury than at the beginning of the year, it may be a sign of the company’s ability to get money, not make it.Therefore, avoid quick conclusions. This could be a sign that the company has taken against investments and is stagnating in its development. Even worse, this could be due to the company selling some key technologies or, for example, its own fleet, which could put it at a competitive disadvantage. A positive cash flow may also be the result of long-term indebtedness, which poses the risk that the debts will be over the company’s head and there will be nothing to repay them with.

On the other hand, if the total cash flow is very low or even negative, it may indicate the company’s inability to generate funds. However, it could also mean that the company acquires new assets (invests), focuses on more profitable markets (optimizes its portfolio’s performance) or repays its existing long-term credits.

It is essential to distinguish between cash flow from operating activities, investment activities and financial activities. The diagnosis at the level of operating cash flow is much clearer. The higher the operating cash flow, the better the situation for the company. Greater operating cash flow gives the company the freedom and flexibility to build its long-term strategy.

Create a simplified cash flow statement

If you do not have a cash flow statement that distinguishes cash flow from operating activities (A***), investment activities (B***) or financial activities (C***), you can create your own simplified cash flow statement. And how to do it?

Similar to profit, cash flow is an amount for a certain period. Therefore, start with the determination of this period (month, year) and write down the balance of money in the company’s treasury and current accounts at the beginning of this period (IB as the initial balance) and at the end of this period (EB as the ending balance). Investment cash flow refers to the purchase and sale of fixed assets. It is the difference between the income from their sale and the expenditure on their acquisition. To find out the amount of the financial cash flow, prepare repayment schedules for loans and credits, write down their use and repayment of the principal in the given period. Add the information on whether there was a payment of profit shares or, conversely, contributions to the registered capital or additional contributions outside the registered capital in the given period. You can calculate the operating cash flow by substituting the values into the equation A*** = EB − IB − B*** − C***. That’s how to find out if you are really making money.

The operating cash flow should be clearly positive. The company should make profit through the activities because of which it is on the market. The aim is to effectively use the company’s money for its development, use market opportunities, and income to finance not only investments but also profit shares to its owners.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.