Indebtedness indicators measure the extent to which a company uses debts to finance its activities in addition to its own resources and also shows the company’s ability to meet its liabilities. These indicators assess the financial stability of the company and include a number of indicators. The company’s ability to repay its debts is undoubtedly affected by its ability to generate cash flow. And what indicators should you watch to maintain proper financial stability?

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

Risk equalization rule

Financial stability is a condition where a company is able to cope with crisis situations without major problems and is resistant to external financial pressures, either due to its main debtors, or, vice versa, from its creditors, or due to the development of the economy. Ensuring financial stability should be one of the key tasks of a company’s financial management.

The relationship between own and external resources is a key issue in optimizing the financial structure. What is the optimal ratio? The answer is not quite simple. External money is cheaper than your own. Some indebtedness is desirable because it promotes the return on invested capital. On the other hand, rising debts reduce the company’s financial stability. An indebted company becomes riskier for banks and less suitable for credit granting with good interest rates. In other words, if you do not have debts, you do not bear the risk of their non-payment. Too much equity, however, makes it difficult to achieve potentially higher profitability. What to do about it then?

The business owner is the last person who can claim something from a failing company in the event of bankruptcy. Precisely because of this risk, it is safer for business owners to hold only as much equity in the company as the value of fixed assets.

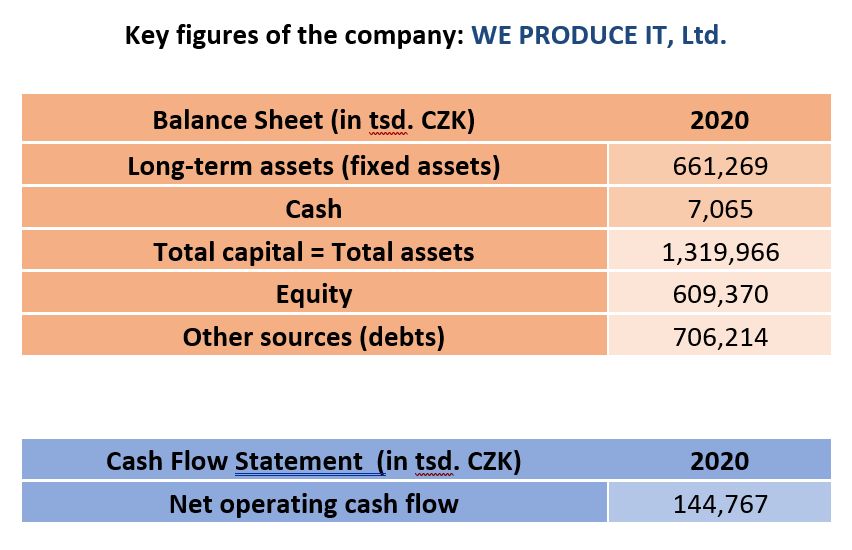

Use a model company "WE PRODUCE IT, Ltd." for the sample calculations in the examples below:

If equity = 609,370 tsd. CZK, and long-term assets = 661,269 tsd. CZK, then equity < long-term assets = favourable situation.

Debt ratio indicator

🔢 Debts / total capital * 100 [%]

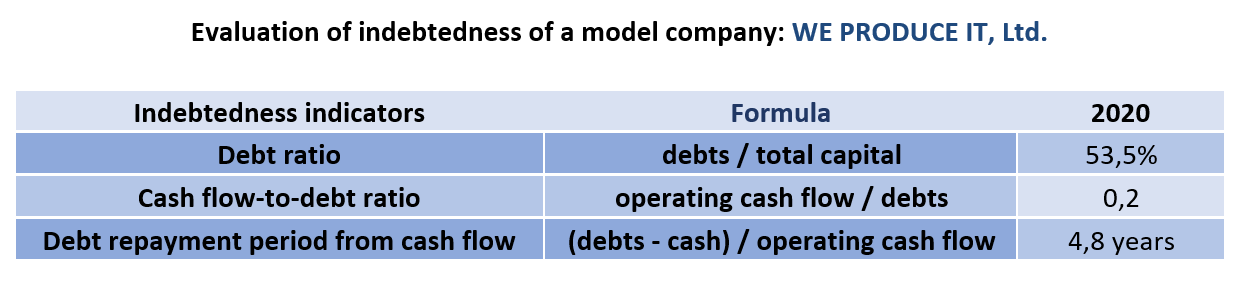

Example (calculation with data from a model company): 706,214 / 1,319,966 * 100% = 53,5%

The ideal indicator for assessing the overall long-term financial stability is the ratio of the company’s total debts (external resources in books) and the total capital that the company uses (total liabilities in books).

Debts include not only the outstanding principal of credits and loans, but also posted but not yet paid salaries, or invoices received from suppliers that have not yet been paid at the time. All in all, a company can actually be completely debt-free only once at the time of its establishment, when only the registered capital and the corresponding funds appear in the founding balance sheet.

It is therefore clear that a certain level of indebtedness is necessary. However, it is advisable to watch the upper limit of the share of debts in total liabilities. In short, debts must not get out of your hand. All creditors will know whether the debts have exceeded the tolerable limit by the negative equity in your balance sheet. This is a strong risk factor that significantly reduces the company’s creditworthiness.

From the point of view of the indicator of total indebtedness (debt ratio indicator), the unbearable situation of over-indebtedness will be reflected in the fact that debts exceed total resources and the indicator will be more than 1.

Cash flow-to-debt ratio

🔢 Cash flow from operations / debts

Example (calculation with data from a model company): 144,767 / 706,214 = 0,2

If you measure the cash flow from operating activities and all the debts of the company (external resources in books), you will get an idea of the debt relief level. This indicates the company’s ability to pay its debts with operating cash flow, i.e. its own financial strength.

In practice, a result of 0.2 to 0.3 is considered a reasonable value, i.e., when expressed in currency, every hundred crowns of debt are covered by 20 to 30 crowns of money brought by company’s operating activities.

If the value of this indicator decreases over time, be careful, because it indicates the growing tension of your economic situation.

Debt repayment period from cash flow

🔢 (debts – cash) / cash flow from operations

Example (calculation with data from a model company): (706,214 – 7,065) / 144,767 = 4,8 years

It is important for a company to know the average debt repayment period. This indicator tells how many years it will roughly take for the company to repay its debts.

In addition, the development of this indicator indicates the ability of the company’s management to manage the financial situation. The lower this indicator, the greater freedom and flexibility it gives the company to build its long-term strategy without restriction and interference from external financial resources. The cash flow debt repayment period indicator has a very good explanatory power, thanks to which it is used in a number of creditworthiness models evaluating the company’s overall financial health.

Low dependence on creditors usually presents a result within 3 years; contrarily, the resulting value higher than 30 years already indicates a serious threat to the company’s financial stability.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of