Different methods are used for cash flow predictions. We offer a selection of best practices so that you can prepare a cash flow plan yourself using the planned income statement and base it on consideration of future investments and credits.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

Liquidity plan

Managing a cash flow without information about future income and expenses can be compared, with a little exaggeration, to walking with your eyes closed. If you don’t know what obstacle awaits you ahead, you cannot effectively decide on the next step. Similarly, due to unavailable information about future available cash, you don’t know how your decisions will affect the company’s ability to pay liabilities.

The key tool is the liquidity plan. As companies make decisions with an impact on cash in the near and distant future, the cash flow plan should include both a short-term period of days and weeks and a long-term outlook determining the company’s needs for investments and long-term credits. The medium-term plan then monitors the use of operating loans, but also, for example, foreign currency movements.

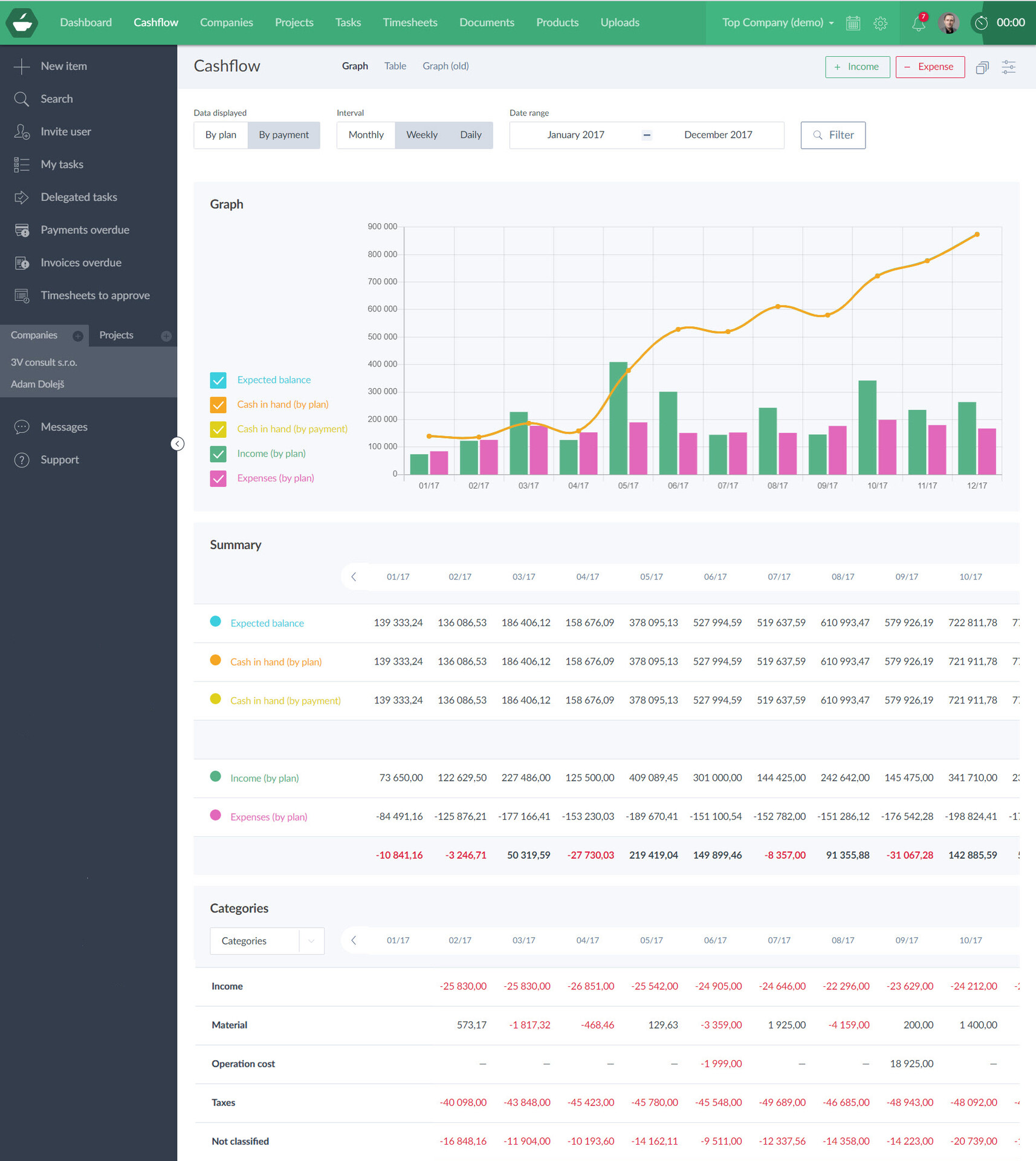

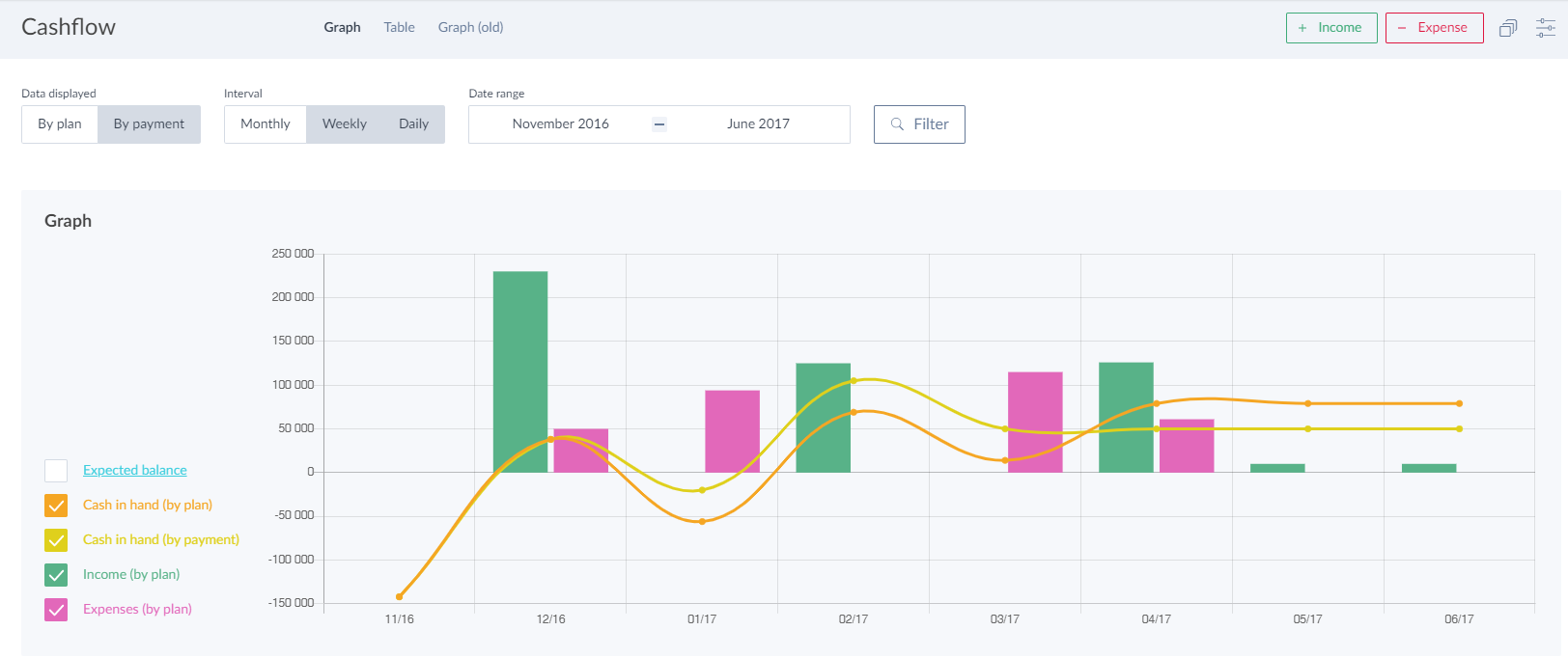

The preparation of financial plans is very difficult for many companies and includes time-consuming calculations. Manual processing within a strategic financial plan is therefore not only laborious, but important links can often be omitted. This leads to a reduction in the quality of the plan. Because of this, it is advisable to use software for cash flow management and planning. You can plan cash flow in Caflou, for example:

In addition, you can compare scheduled cash flows (orange line in the graph) with actual money movements by date and amount of payment (yellow line).

Time period of plans and a source of data for forecasts

The length of the outlook for short-term and long-term plans depends on many factors. Your line of business, customer segment, seasonality of sales, maturity of payments to suppliers and from customers, length of the production cycle, method of revenue and cost planning or data availability all play a role. However, medium-term cash flow plan should cover at least the time from the start of performance for the customer until the collection of the receivable.

The main sources of data for the medium-term plan are the concluded contracts and the production plan. However, it is also based on a short-term plan, which, by contrast, is based mainly on issued invoices, received invoices, current amount of wages and filed tax returns. The long-term plan reflects both the medium-term cash flow plan as well as business plans, investment plans, personnel and production plans.

Plan according to the income statement

Company accounting does not primarily focus on income and expenses, but costs and revenues. You can use this when planning cash flow. You can create a plan based on your revenue and cost budget, taking into account payment and collection time lags. For example, the wage calculated for September will be paid in October. For the purposes of compiling the cash flow plan, it is appropriate to divide customers and suppliers according to the agreed invoice maturities. At the beginning of the planned period in which you will generate revenues, revenues from the previous period are likely to be collected. Consider not only the initial balance of funds, but also the amount of receivables and similar short-term liabilities, which, in the given period, will represent collections and payments related to revenues and costs of the previous periods. Don’t forget to also add the considered purchases of fixed assets and credit payment schedules to your financial plan.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.