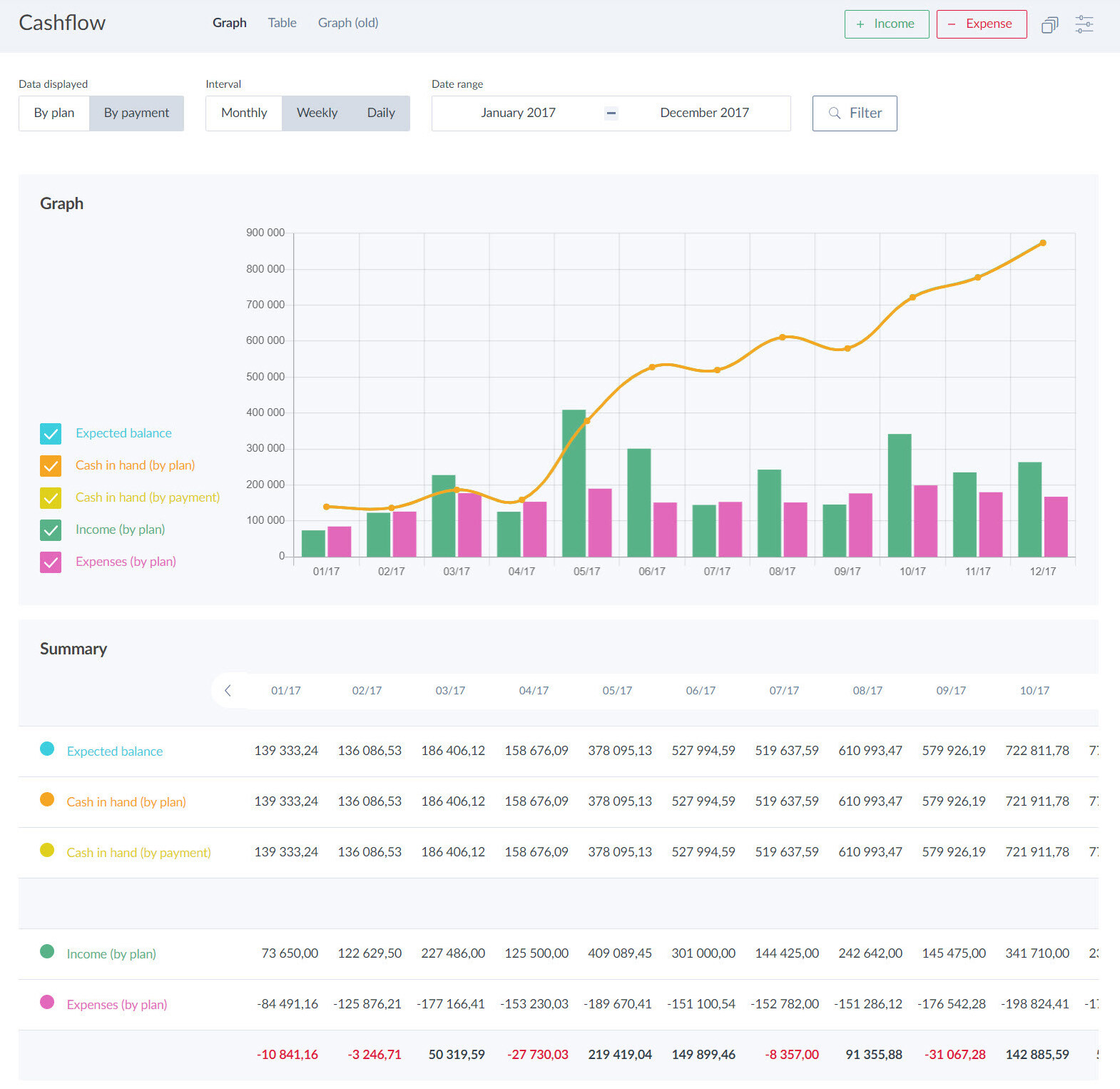

Profitability indicators show the effect that the company is able to achieve in the long run. In addition to the accounting profit, one of the significant effects is also cash flow, especially operating cash flow. Cash flow planning and analysis has become a common part of financial management. It helps identify and resolve financial problems and reduces financial risks. And what cash flow-based profitability indicators should a responsible company start monitoring?

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

Cash flow for analysis

Cash flow-based indicators are based not only on the balance sheet and income statement, but also on the cash flow statement. The results of such indicators are therefore considered to be most reliable. If you have a cash flow statement, look for the operating cash flow summary.

If you don’t have a cash flow statement available, two details from the income statement will suffice. Take the amount of the operating profit/loss and add depreciations, which is a cost in bookkeeping that reduces the economic result, but it is not a monetary expense. The calculated value from the income statement is not as accurate as the amount of operating cash flow, but it will give a rough idea of how much money your company generates from its operating activities, i.e. why you are in the market, for a given period. However, the lower accuracy sufficiently offsets the availability of this figure if you do not prepare a cash flow statement.

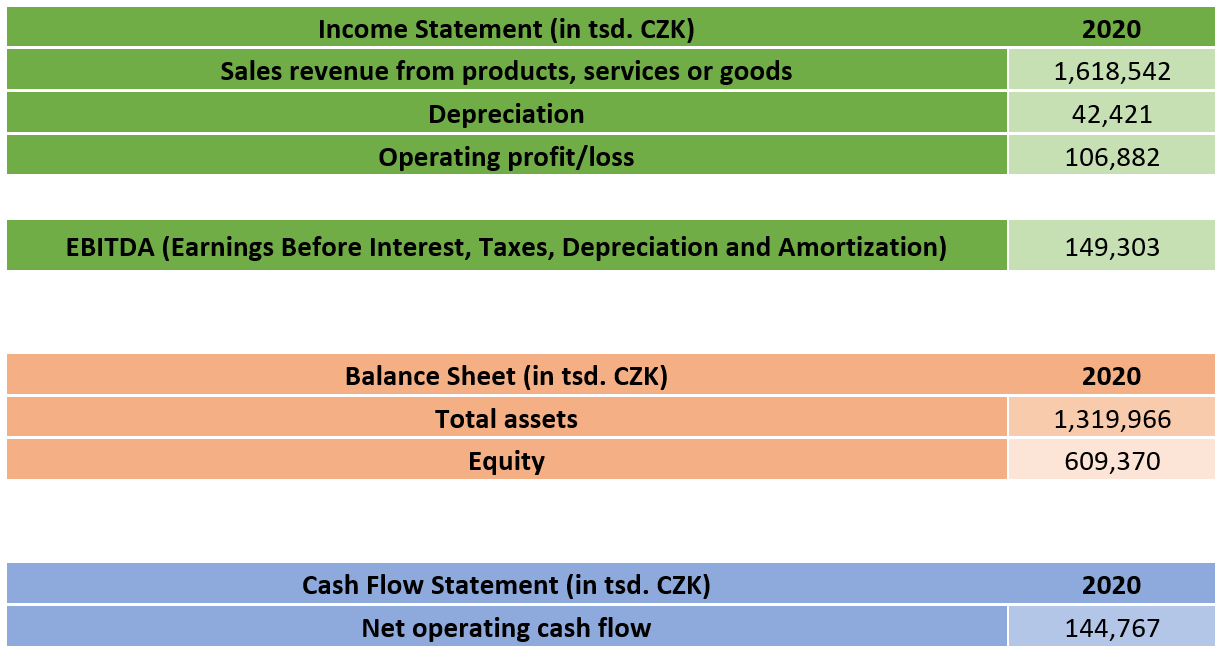

Use a model company WE PRODUCE IT, Ltd. for the sample calculations in the examples below:

Key figures of the company: WE PRODUCE IT, Ltd.

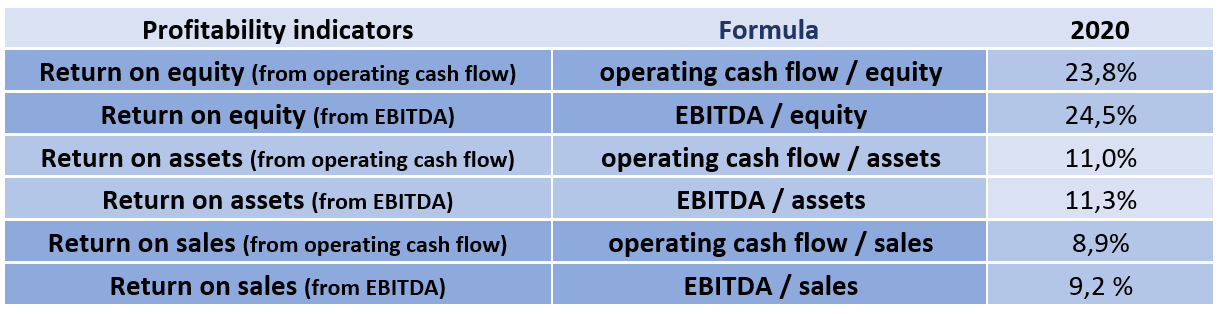

Cash flow Return on Equity indicator

🔢 Net operating cash flow / equity * 100 [%]

Example (calculation with data from a model company): 144,767 / 609,370 * 100% = 23,8%

What is the total effect, expressed through cash flow, that the value of equity has, i.e. the book expression of the company’s wealth? The wealth of a company or the equity is composed of two parts. The first comes from the owners. This includes the registered capital which is usually used to establish a business through the associates’ contributions. Owners can also help the company financially through additional contributions to capital funds.

Another source of wealth is the economic results achieved by the company through the done business. Retained earnings increase wealth, accumulated losses decrease it. Formally, they are kept in the books either as the economic results for the current period and previous years or as funds formed from profit. You can find the total wealth of the company in the balance sheet in the Liabilities section on the line usually called "Equity".

Cash flow Return on Assets indicator

🔢 Net operating cash flow / total assets * 100 [%]

Example (calculation with data from a model company): 144,767 / 1,319,966 * 100% = 11%

This indicator will tell you how much of the income is generated from the capital tied up in the company’s assets. The company’s assets are divided into fixed and current assets. Fixed assets represent the value of software, computers, office equipment, cars, machinery and devices, buildings and land reduced by value adjustments, specifically by the current value of depreciations.

Current assets are stocks of materials, products and goods, receivables from customers and the petty cash and funds in company accounts. You can find the total value of assets in the balance sheet on the line Total Assets, column Net value of the current accounting period. It stands that the higher the profitability, the better for the company. If the cashflow return on assets indicator is not as high as you would like, or decreases over time, it may mean that you have more unproductive assets.

This indicator is your early warning signal to look for the cause of this unfavourable situation, whether it is a high value of receivables with longer maturities, or stocks of materials or products laying idle in warehouses for a long time, or high investments in production halls, machinery, or other devices where you are not using their full capacity.

Cash flow Return on Revenues indicator

🔢 Net operating cash flow / revenues * 100 [%]

Example (calculation with data from a model company): 144,767 / 1,618,542 * 100% = 8,9%

You already know what effect business brings to owners and to what extent company assets generate money. Now let’s look at how much money each penny of the turnover brings. Turnover is another term for the sales of your products, services or goods, i.e. sales of the items because of which you are in the market. The cash flow return on revenues indicator does not include revenues from sold fixed assets or revenues from the sale of materials. This way you can monitor whether the expected benefit from sales of your main services corresponds to reality and what is the development of sales efficiency. If the indicator decreases in individual years, it means either an increase in sales or a decrease in their yield. In other words, each penny of the turnover brings less money to the company.

Choosing an indicator for your company

From the point of view of the company owner, the key indicator is the return on equity. If you have a bottleneck in production, use capacity to the full and look around for new production facilities, or there are more and more of those who demand longer maturity among your customers, be sure to also look at the return on assets.

Return on revenues is necessary to assess the effectivity of sales.

Evaluation of profitability of the company: WE PRODUCE IT, Ltd.

Whether you are monitoring all three of these cash flow-based profitability indicators or choosing just the one that is best for your situation, they can help you detect warning signs of potential payment difficulties and better assess your company’s internal financial potential.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of