Cash flow management is also called working capital management or liquidity management. Whatever you call this crucial part of financial management, it is the company’s ability to meet its obligations and direct earnings to further company development. Reliable cash flow planning is an important helper in building and maintaining a competitive advantage on the market.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

Key tool for managerial decision making

Managers who have an immediate overview of the status and activities of the company have an undeniable advantage thanks to the ability to make more effective decisions. Finances and their management are the basis for building and maintaining the long-term prosperity of the company. Managing a cash flow without information about future income and expenses can be compared, with a little exaggeration, to walking blindfolded. If you don’t know what obstacle awaits you on the road ahead, you cannot effectively decide on the next step. Similarly, due to unavailable information about future available cash, you don’t know how your decisions will affect the company’s ability to pay liabilities.

As companies make decisions with an impact on cash in the near and distant future, the cash flow plan should include both a short-term period of days and weeks and a long-term outlook determining the company’s needs for investments and long-term credits. The medium-term plan then monitors the use of operating loans, but also, for example if you do business abroad, foreign currency movements. The basic task is to arrange and ensure the permanent solvency of the company. The requirements, which are the basis for the obligation to pay, are based not only on the received invoices and labour costs. There are also the liabilities to the state in the form of fees and taxes, liabilities to banks in the form of repayment of credits, and the expected investment expenses.

Plan and manage your payment cycle

The production process takes a certain period of time, which begins with the purchase of materials and raw materials, continues with the production, warehouse release of the product for sale, or until the invoicing of deliveries or the performed job. Upon sale, sales are recorded in the books, however, depending on the actual maturity of the invoices, it still takes some time before the money from the sales is collected. Both the times of inventories in the production process and the maturity of receivables together form the time of the operating cycle. When you subtract the average maturity of your liabilities, you will get information about the length of your payment cycle.

Efficient companies can plan the amount of their inventory. This translates into more accurate purchase and selling planning. The strategy involves the automation of the order, invoicing and payment cycle on the purchase side. This ensures timely and reliable information on the amount and timing of future payments. It is also advisable to have efficient processes set up for receivables management, which will allow you to better estimate collection dates.

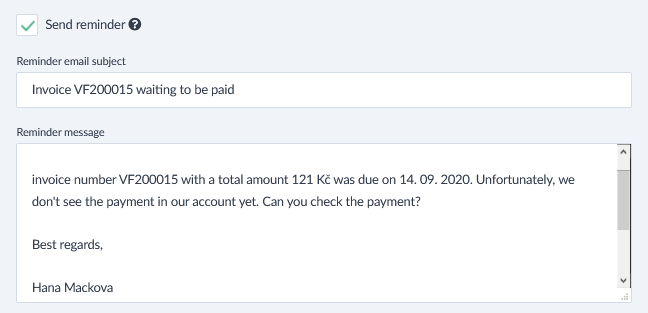

Think about procedures leading to fast order processing, payment matching, monitoring of overdue receivables and an effective reminder system. As a result, standards for settling complaints and disputes with customers also lead to faster collection. Repeatable procedures are effective. Therefore, don’t forget to take only such measures that are sustainable for you in the long run and will continue to work in the future.

What is the power of liquidity management?

The essence of liquidity management is to ensure a long-term balance between income and expenses. A basic prerequisite for effective liquidity management is to have a good plan. Ideally a set of plans for different time periods and different levels of detail. Regular work with them will ensure that all due liabilities are paid in time and also that there will be no need to keep high reserve balances in current accounts.

Reliable cash flow planning makes it possible to reduce the need to use operating loans. Whether it is an overdraft or revolving credit, you will save funds associated with remunerating the bank for their use in the form of interest. In addition, knowledge of future cash flows helps increase certainty when deciding on planned investments, which is a significant advantage for financial management. Thanks to strategic liquidity management, you can more easily use discounts for early payments from suppliers. You will also better hedge against the exchange rate risk thanks to a more accurate plan of income and expenses in foreign currencies.

You are not alone with a smart tool

Many companies consider unreliable receivables and inventory planning to be one of the main reasons for the inaccuracy of their outlooks. The key is therefore the management of working capital. Working capital management affects all parts of the company from purchasing, through production to sales and logistics. While financial resources tied up in inventories, receivables and current accounts make production and sales managers worry less about supply and sales, they, on the other hand, increase the demands on the volume of interest-bearing capital. In order to increase efficiency and strengthen the company’s competitiveness, it is therefore necessary to strive for the greatest possible turnover of individual components of working capital.

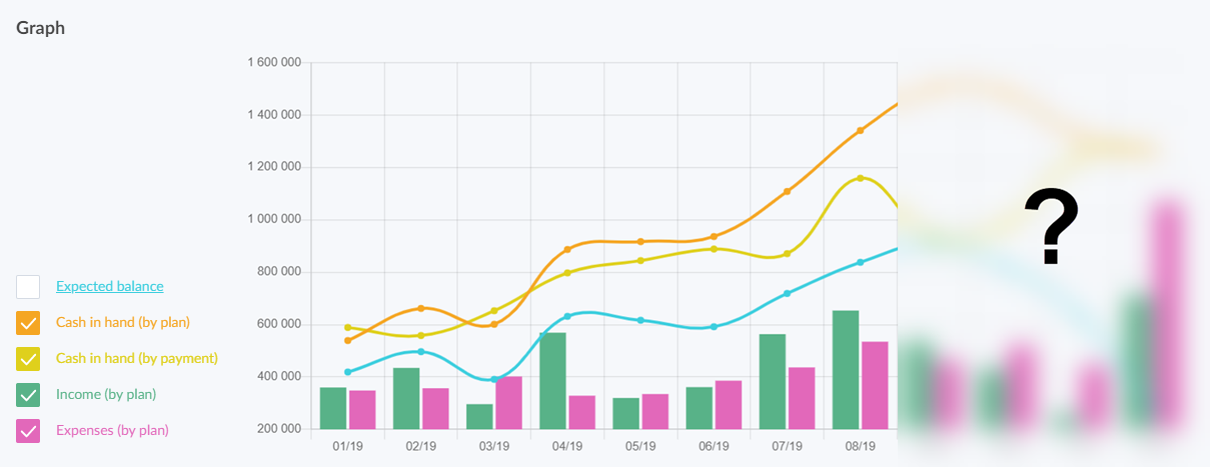

Financial plans are very difficult to prepare without a certain degree of automation. Planning also includes time-consuming calculations. Manual processing within a strategic financial plan is therefore not only laborious, but important links can often be omitted. This is reflected in a reduction in the quality of the plan. It is therefore necessary to use specialized software for cash flow management and planning. A good tool will do a lot of work for you. For example, Caflou cash flow application allows you to show income and expenses by each customer or supplier, by category and also by projects, and at the same time in an overall view of real and estimated cash flow.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.