Definition of the current business environment? It is a tough environment with growing and constantly changing demands on entrepreneurs, their products, services, quality, service and price. An environment in which only rapidly-adapting companies with a competitive range of products and services, companies able to respond flexibly to changes in market conditions and individual customer requirements, can succeed.

As a result of failing to cope with the dynamic development of the market environment, many companies face payment difficulties, financial instability or even impending bankruptcy. If the company is unable to meet the obligations to its employees, business partners or banking institutions due to its financial situation, it comes under pressure from its creditors, there is a risk of employee departure, restrictions or cessation of activities and the associated outflow of customers and, in the last case, the bankruptcy of the company.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

This dark scenario is not uncommon. Companies that have failed to compete regularly leave the market. According to statistics from Bisnode, the European leader in analytics and business information, there was on average one company that ceased to exist due to liquidation for three established companies between 2017 and mid-2019. According to surveys by the independent non-profit civic association T.M.A. ČR (Turnaround Management Association Czech Republic), mostly poor financial management is responsible for a company’s bankruptcy, with the second most common cause being the low ability to respond to the current market situation, followed by a decline in sales as the third most common reason of bankruptcy.

This dark scenario is not uncommon. Companies that have failed to compete regularly leave the market. According to statistics from Bisnode, the European leader in analytics and business information, there was on average one company that ceased to exist due to liquidation for three established companies between 2017 and mid-2019. According to surveys by the independent non-profit civic association T.M.A. ČR (Turnaround Management Association Czech Republic), mostly poor financial management is responsible for a company’s bankruptcy, with the second most common cause being the low ability to respond to the current market situation, followed by a decline in sales as the third most common reason of bankruptcy.

Therefore, most causes of bankruptcy can be prevented. Good financial management is very important. In other words, this means active care for corporate finances and thorough cash flow planning, which will serve as an early warning system for possible financial difficulties. It is obvious that successful financial management is not enough for a company to prosper in the long run. The crisis of a company usually begins long before it makes itself felt in the financial area. Permanent insolvency is only the last phase of the crisis, but it clearly leads to the bankruptcy of the company.

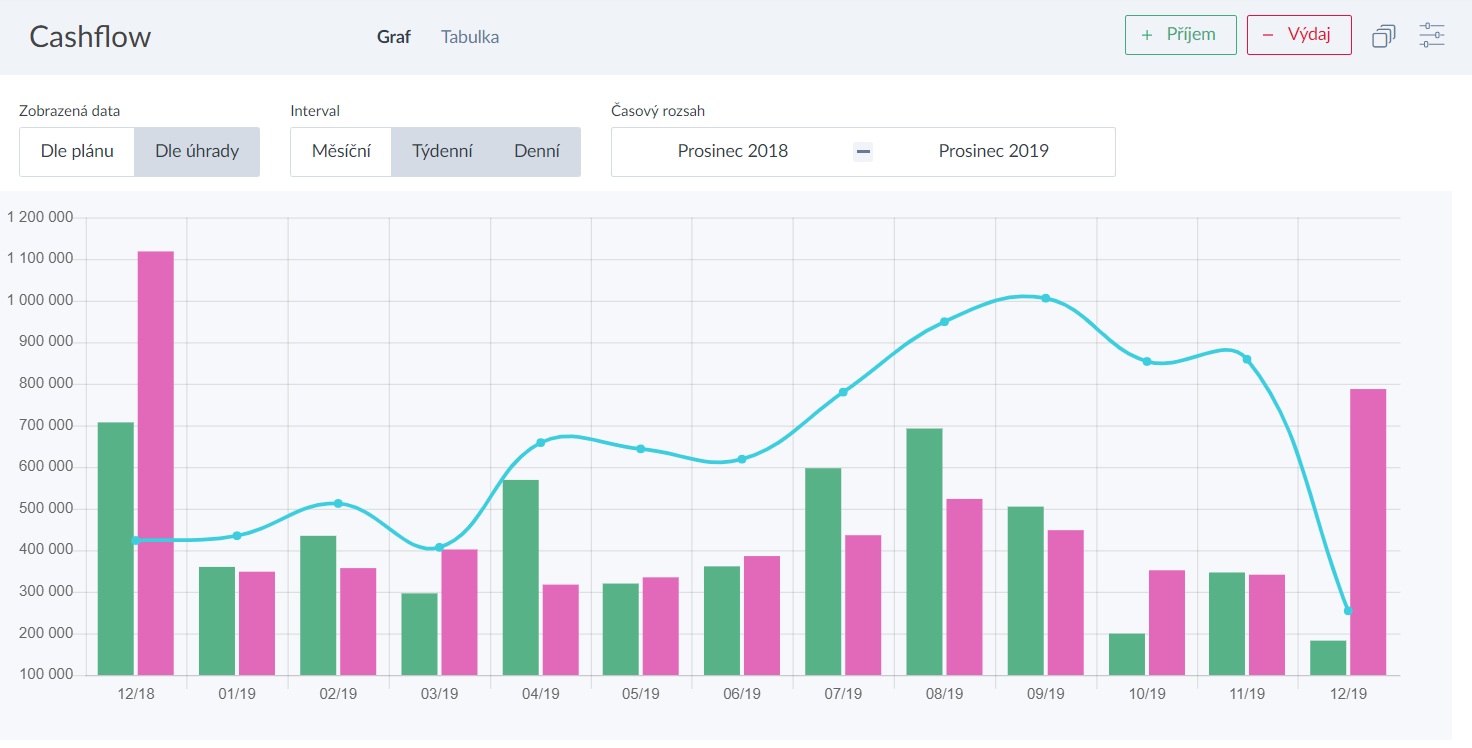

Free cash flow that the company has at its disposal at a certain point in time to finance its activities is very important for financial management and analysis of the company’s ability to meet its obligations. Cash flow planning and analysis is an essential part of quality financial management, helping to identify and resolve financial difficulties and reduce financial risks.

Cash flow planning

Although it is well known that smaller market players suffer from secondary insolvency due to poor payment habits of their customers, companies often find themselves in problematic situations with their non-proactive approach as well, including underestimating debt management. The unlimited confidence that issued overdue invoices will eventually be paid after agreement with the debtor may not correspond to reality. In practice, entrepreneurs encounter the fact that some receivables cannot be collected due to unnecessary limitation of time.

Although it is well known that smaller market players suffer from secondary insolvency due to poor payment habits of their customers, companies often find themselves in problematic situations with their non-proactive approach as well, including underestimating debt management. The unlimited confidence that issued overdue invoices will eventually be paid after agreement with the debtor may not correspond to reality. In practice, entrepreneurs encounter the fact that some receivables cannot be collected due to unnecessary limitation of time.

Cash flow therefore needs to be planned in advance in the first place. When planning cash flow, st art with the definition of cash receipts (cash sales, debt collection, borrowings, contributions and additional contributions of owners) and cash expenditures (payments of received invoices, payroll, purchase of land, buildings, machinery and equipment, tax payments, loan and credit payments). Distinguish between regular and recurring cash flow and random income or expenses in both categories. You can also divide both income and expenses into real (based on contracts, invoices already issued or received) and probable (based on business outlooks). This will allow you to model various combinations of the resulting cash flow, which can occur in an optimistic or pessimistic scenario of the situation.

You can keep a cash flow plan as a simple overview, use records of individual past payments and base the outlook on the due dates of received and issued invoices. Nowadays, it is no longer necessary to rely only on spreadsheets such as Excel, LibreOffice Calc, Google Sheets or OpenOffice.org Calc. Software solutions specializing in cash flow management and planning are also available on the market which, in addition to the cash flow forecasts and analyses, also offer an elegant visualization of the future status development of free cash flow when various parameters are defined, usually not only for the company as a whole, but also by customers, projects or other activities.

Steps to improve cash flow

Not only companies struggling with a lack of funds can benefit from quality cash flow management. The market success of the company goes hand in hand with the increased need for financing. The steps that will lead to the improvement of cash flow can be successfully applied to all companies.

Step One: Focus on earnings. Some companies save, others make money. However, the market does not always allow you to permanently increase turnover and sell only products and services with the highest price. Also, the effort to increase sales prices often encounters the reluctance of customers to pay more. However, your strategy may be to narrow your product range with a focus on high-margin products and services as well as the most frequently requested products or services, where you take advantage of the savings gained from experience in recurring activity.

In the case of a tight budget, at least a short-term reduction in the provided discounts will also help. It is also worth to ensure and maintain the quality of products or services to avoid complaints and therefore additional costs. If you have a sufficient market position, you can persuade customers to pay for your products, goods or services earlier. You can also support cash payments by offering a certain benefit to customers.

Step two: Review your business expenses. Of course, not every company spends unnecessarily. In most cases, there are always some expenses that can be saved on without affecting employees. Although, if the cash flow outlook is unsatisfactory in the long run, a reduction in working hours or a suspension of hiring may be inevitable. When planning cuts, consider the significance of individual items of expenses. Prioritize those where even a small reduction will make a significant difference in the overall cash flow. If the smaller expenses represent a significant share in the total expenses, it is also appropriate to revise them in case of insufficient financial situation of the company. A temporary reduction in costs will not only help restore financial balance, but also profitability. Pay attention to early payments of received invoices as well. Obligations are, of course, to be paid within maturity, but this need not be immediately upon acceptance.

Step three: Sell unnecessary assets. These may be machines or equipment that have not been used for a long time. This also often includes surplus or slow-moving inventories that tie up money without bringing any value to the company. If it is possible to sell them, do so. Money is supposed to flow; when left in unused assets, it does not benefit your cash flow. However, if you do need manufacturing equipment or cars for your business, you can still consider income from their sale. Leaseback can be a solution involving a lot of equipment. The leasing company will offer funds for the purchase of your assets, which will improve your cash flow, and at the same time you will continue to use the assets for a fee in the form of lease payments. This makes it easier to overcome difficult financial periods. Similarly, you can sell your receivables to factoring or forfaiting companies. The solution may also be the earlier payment of issued invoices.

Financial stability cannot be guaranteed, but it can be foreseen and prepared for. In order for a company to succeed in a highly competitive environment and maintain its financial health, it needs to make effective use of all the resources at its disposal, be it human, informational, financial or other. In order for the company’s management to have a realistic idea of whether resources are used efficiently, create company value and contribute to the stable position of the company, it is necessary to use at least one tool for early warning of possible problems. This tool is the cash flow plan.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.