...regardless of the tool

How much do you agree with the statement that having an overview of how the company is doing is more important now than ever? Whatever your answer is, planning the company’s financial situation is useful at all times. But how best to grasp cash flow, and how to start planning it at all in the first place?

Many companies lack a methodology for creating a cash flow plan and tools for its management. At the same time, more and more business owners and managers need not only to retrospectively evaluate the economic benefits of the company’s activities, but also to look to the future and be able to estimate the time discrepancy between expected incomes and planned expenses as accurately as possible.

This article will show you how to do it. You will learn where to start if you finally want to plan your cash flow and keep looking ahead.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

💾 Download this article as an e-book: How to start with cash flow planning (ebook)

Step #1 Gather the right data sources

“Cash flow planning is difficult.” “I don’t know how to start.” These are examples of sentences that are repeatedly heard from managers who have the task of starting to monitor cash flows. No matter what you hear about the complexity of cash flow planning, it’s not rocket science. Use logic and take a smart approach. That is, an information system. Take the data sources you have at your disposal. It can be an invoicing system, a customer relationship management system, bank statements.

Didn’t we forget to mention accounting? Well, we didn’t. Be honest, are your accounting documents available quickly enough? Even the fastest done accounting will give you reports on the past month with a certain delay. And you want to look ahead. Accounting monitors every penny and it is necessary to wait for this accuracy. In managerial perspectives, the timeliness of information is more crucial. Even at the cost of some inaccuracy. After all, we are looking to the future, and it is not possible to achieve accuracy there.

We look at future cash flows through an imaginary crystal ball. But in order for it not to be a complete divination, a little methodology would be useful. However, a level of detail provided by high-quality managerial decisions will suffice. Although the need for detail is a purely individual matter, it is generally essential to have an overview and to have it in time. So, you only need such data sources that include the intuitively largest package of incomes and expenses. These are usually invoices, but they can also be, for example, salaries or other types of expenses, such as credit instalments.

It must be clear from the data sources when and how much money leaves the company and, on the contrary, when and how much money is to flow into the company. You also need to clarify the starting point, i.e. the first day of the period you start monitoring your cash flows. Your planned cash flow will depend on the initial state of money. You can usually find it from your bank statement.

💡 The information needed to plan cash flow is available in one of your information systems (business management system, invoicing, CRM…). Focus on the important groups of incomes and expenses and start with the initial money situation.

Step #2 Start with incomes

The first item in your cash flow plan is the balance of money in the accounts or the treasury. Let’s start with the planning. What would you say will follow? Calculation of expenses? In the end, they are much more tangible than incomes. We know who we owe. But this is a typical trap that you can now be careful about thanks to the title of this step. Don’t start planning cash flow from expenses, but from incomes.

Although intuition may whisper to you that you need to start writing down expenses, the key to success lies in the most realistic knowledge of expected incomes. The inflow of money is certainly less predictable than your expenses, but you need to know the possibilities that the collected incomes offer you with a certain probability for good planning. Here’s how your cash flow plan will allow you to answer questions like: “Aren’t these incomes too low for these expenses?” In short, the goal is to determine the amount of money that will be available on a particular day.

Can’t afford to be in the red? Would you be in danger of financial sanctions, higher interest rates, suspension of supplies or disruption of business relations? Are your employees sensitive to payday delays? If you don’t have other sources of money other than incomes, your business will probably be more sensitive to shortages of money. If it is essential for the viability of the company to estimate insufficient cash flows in a timely manner, it is not possible to rely on accounting that is compiled on a monthly basis. In such cases, it is necessary to monitor cash flow weekly or even daily. A daily view is very useful when the stability of a company is threatened by shortages of money due to a delay in collections, even by a single day.

But it doesn’t have to be just legislative, or seemingly obvious, impacts that will make you start monitoring cash flow more accurately. By delaying payments, you let business partners know that they are not that important to you. You may not even notice that this is the beginning of the end of your cooperation. Similarly, an employee who formally has a payday on the 20th in their employment contract, but is accustomed to receiving the salary on the 15th of each month, does not have to necessarily show their dissatisfaction, if they tie their other payments to the expected payday. Nevertheless, disturbed expectations are a significant psychological barrier that reduces work motivation and productivity.

Having a well-grasped income-based cash flow will allow you to realistically expect payments to not take place when your employees and business partners are accustomed to. This makes it easier to avoid the creeping and at the same time long-term negative impacts of dissatisfaction with the beginning of the liquidity crisis. Of course, the cash flow plan will not bring you additional money to pay for expenses. However, you gain the time needed to prevent problem situations, which you can solve through active communication or other measures to improve cash flow.

Economic success is about people, not numbers. What you see in the mentioned crystal ball can ultimately come true, depending on how your team treats customers and whether you show your business and financial partners that you value them. Cash flow forecasts are also useful for refining your expectations and the expectations of those with whom you work or owe money to and for whom the creditworthiness of your company and the probability of repaying credits are essential. Thanks to a clearer income prospect, it is easier to plan the support of the company’s future activities with economically healthy expenses.

💡 Logically correct cash flow planning always starts with incomes, not expenses. This will give you the ability to prevent problems and find solutions before a mismatch between incomes and expenses occurs.

Step #3 Categorize your incomes and create collection scenarios

The reason for the existence of business entities on the market is income from products, services and goods. Therefore, a key item in the company’s cash flow plan will be the collection of receivables from the sale of goods, own products and provided services. Differentiate these incomes in your cash flow plan according to the maturity of the invoices. The strength of a good cash flow statement lies in the ability to model it and create possible scenarios. Divide the incomes into at least three categories and then derive at least three development scenarios from them.

💡 Have you already tried CAFLOU® - the 100% digital cash flow software ❓

The first income category of your cash flow covers invoiced performances. In this category, invoices are already on your table, their due date is also set, and you have more or less an idea of when you can expect these incomes based on your experience. The second category of incomes consists of services that have not yet been invoiced but are at least partially based on contractual relationships and agreements, such as a supply framework agreement. The date of collection of these incomes is rather indicative, as it is based on your best estimate. Finally, the third category of incomes is represented by future collections thanks to new customers, segments or sales of new products, where you rely on business prospects in estimating payment terms.

To make the cash flow plan as realistic as possible, add a simple mathematical calculation based on a multiple of two parameters to each income category. The first is based on the Probability (P) of whether you can expect the income on the day listed for that income.

| Probability | Description | Value |

| High | Collection delays are likely to occur. It is necessary to expect delayed income. | 3 |

| Medium | A delay in collection cannot be ruled out, and it is reasonable to assume that a delay will occur. | 2 |

| Low | Delayed collection is unlikely, but possible, and it can be assumed that the collection will not be postponed. | 1 |

Based on the planned maturity of invoices and on experience or analysis, on the fields your customers are from and on how they are most likely to be affected by the current situation, consider the probability with which the income may be delayed. Also consider whether you are in a stronger or weaker bargaining position on the market.

The second parameter is the Degree of Impact (D). This corresponds to the significance of the delay in the income for cash flow. The importance of income is given by its amount. Any delay in a larger amount can significantly jeopardize your cash flow.

| Impact | Description | Value |

|

Almost imperceptible impact |

The delay in this income is not significant for cash flow. Cash flow is not threatened. | 1 |

|

Medium degree of impact |

The delay in this income disrupts cash flow. Failure to address it will jeopardize cash flow. | 2 |

|

Very significant impact |

Delay in this collection significantly jeopardize cash flow. The situation requires major measures. | 3 |

You now have a basis for modelling income scenarios. You see the ideal condition, but also the variants. You can grade both the P and D parameters on a simple scale (for example 1 to 3) so that you can more easily evaluate which incomes need to be paid more attention to. These will be all those with the multiple of parameters P and D being a higher number. For example, an income with a Probability of delay 2 and a Degree of Impact 3 has a multiple of 6. It needs to be paid more attention than an income with the same Probability of delay but an almost imperceptible Impact (2 x 1 = 2). With modelling and logic-based scenarios, you know what incomes you can count on. And you can start thinking about possible measures to compensate for any outages or delays in incomes from the activity because of which you are on the market.

Other items in your cash flow plan are also eligible in case of incomes, but do not reflect the company’s performance. These include incomes from the sale of own assets, received bank loans, an increase in the overdraft facility, or loans from owners. Think of them as possible solutions to insufficient cash flow, but at the same time be aware that they are often associated with future expenses. For example, you will miss the sold assets in the future; if you replace them with leasing, the current income from the sale will be replaced by future leasing payments. You will repay the loans together with interests. In short, in addition to the time point of view (when the money comes), it is also useful to apply a material view, which concerns operating (own business activities), investment (sale of cars, equipment, buildings, etc.) and financial (incomes from owners and banks) incomes.

💡 Divide incomes into several tangible groups according to the considered maturity and model possible scenarios according to the probability and degree of impact on cash flow.

Step #4 Categorize liabilities and other expenses

You have now successfully completed the first three steps in cash flow planning. You have gathered data from the information system, started with incomes and divided them into categories so that you could model scenarios. Incomes are absolutely crucial for cash flow. You adjust your expenses to them. Remember, there are companies that make money and companies that save. Once you have an idea of the incomes that are likely to arrive on a given day, start with expenses. You have more control over them, because you are responsible for them and you know when to pay them.

You have now successfully completed the first three steps in cash flow planning. You have gathered data from the information system, started with incomes and divided them into categories so that you could model scenarios. Incomes are absolutely crucial for cash flow. You adjust your expenses to them. Remember, there are companies that make money and companies that save. Once you have an idea of the incomes that are likely to arrive on a given day, start with expenses. You have more control over them, because you are responsible for them and you know when to pay them.

💡 Have you already tried CAFLOU® - the 100% digital cash flow software ❓

It is worth considering important groups and their maturities even on the expense side of cash flow. We recommend starting the cash flow expense side with liability items. Include your liabilities in four categories of regular expenses. These are liabilities to suppliers, liabilities to the labour force, also to banking institutions, and consider liabilities to the state as well (social security and health insurance contributions, taxes). If relevant to you, add a fifth category of liabilities to partners. Probability and impact analysis is not done here. It is not practically usable. Although you may intuitively feel the need to give priority to those who are key to your business, it’s not right to prioritize creditors. If you don’t have enough income to pay to everyone, you should distribute the available amount among your creditors in a fair manner.

Thanks to the current steps in cash flow planning, you have an idea of how much money will flow in a given period and the amount of expenses associated with contractual obligations. You can determine how much money the company has left or lacks by deducting the payments of the mentioned liabilities from the money available at the given moment. Add additional expense items after this subtotal line. These are all considered payments to which you are not contractually obliged, for example repairs and maintenance, education or marketing.

Answer the question where you want to be included – among those that make money or those that save. Don’t cut expenses at this time, just include them in the cash flow statement with a possible payment date. There may be expenses among them, which, when cut, could limit you in terms of achieving incomes in the future. For example, in order to reduce the costs of repairing a production machine, it will be necessary to invite a subcontractor to complete the order, which will reduce the resulting margin. Similarly, reducing marketing expenses will reduce the reach of promotion and limit additional demand.

💡 Add liabilities arranged in several logical categories to the cash flow, calculate the available balance, and then add other considered expenses to which you are not contractually obliged.

Step #5 Evaluate your cash flow and include Factor X

If you have already started planning cash flow with us, you have included the initial money situation as well as all considered incomes and expenses in your cash flow plan. This results in a surplus or need for money. So, if you find that you can expect less incomes than expenses at some point and the initial reserve of money is not enough to cover them, there is a step in which you look for possible measures for possible scenarios to best deal with the situation.

Possible solutions are first based on considerations on the income side – is it possible to arrange advance payments, shorten maturities, achieve new sales? Is it possible to get an overdraft or a credit limit? Then approach the expense side – can you postpone due dates with business partners or institutions through active communication? Can you postpone loan instalments or tax payments based on a request to change the payment schedule? By modelling a cash flow plan, you have a chance to think ahead. Entrepreneurship is a long-term affair. It’s worth being proactive and not waiting for the concerned party to respond.

The cash flow plan is ready. Almost ready. Even good forecasters may be surprised by Factor X. It’s something you didn’t expect. Because the plan should be as conservative as possible, don’t think of pleasant surprises on the income side. Add Factor X to expenses. This may include, for example, when an employee leaves the company, i.e. a situation where you suddenly have to pay severance package. Or the performance of a contract may be delayed, which entails the inconvenience of paying a penalty. There are a number of situations that are unlikely but cannot be completely ruled out. Without our intention to bring them upon us, it may happen that we flood a neighbour or that our truck crashes into a family house on the way and we have to pay damages. Let’s believe that these crisis scenarios will not occur, but if they do, the significance for cash flow is considerable.

But how to quantify Factor X? After all, we don’t know if the situation from the crisis scenario will happen and how much it will cost. Risk managers have the tools to quantify this. We recommend involving common sense. This is not so much about the most accurate number, but the principle that you take Factor X into account. And if the situation does not occur, you turn the “saved” amount into a reserve. You can use the created reserve for opportunities in the future. Comprehensible and clear approaches are easier to keep up-to-date so that information is quickly at hand.

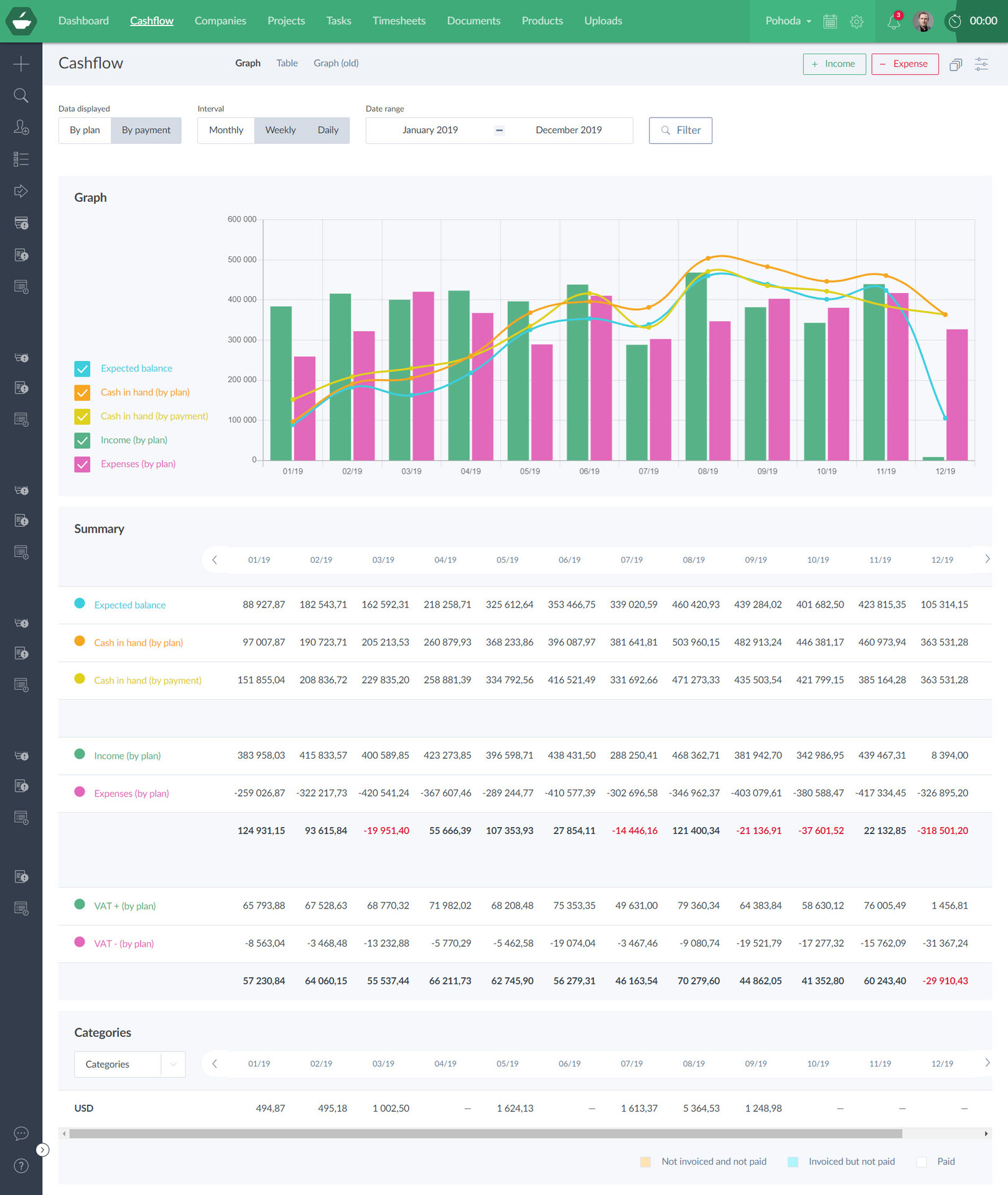

A tool that can take your cash flow considerations, whether Excel or Caflou, must fit your logic and allow you to think about cash flows on the whole. For some, BI (business intelligence) tools are great, but keep the price-performance ratio in mind. Smart applications like Caflou also include changes in exchange rates and databases, which can be used as a historical basis. You are now sowing the seed for cash flow management even after the current need to resolve the income-expense mismatch is gone. So, create a tool that is as maintenance-free as possible.

💡 Focus on cash flow scenarios and consider measures against cash flow outages. Add Factor X and monitor the financial reserve in cash flow.

How to start with cash flow planning (regardless of the tool) - SUMMARY:

- Gather the right data sources: The information needed to plan cash flow is available in one of your information systems. Focus on the important groups of incomes and expenses and start with the initial money situation.

- Start with incomes: Logically correct cash flow planning always starts with incomes, not expenses. This will give you the ability to prevent problems and find solutions before a mismatch between incomes and expenses occurs.

- Categorize your incomes and create collection scenarios: Divide incomes into several tangible groups according to the considered maturity and model possible scenarios according to the probability and degree of impact on cash flow.

- Categorize liabilities and other expenses: Add liabilities arranged in several logical categories to the cash flow, calculate the available balance, and then add other considered expenses to which you are not contractually obliged.

- Evaluate your cash flow and include Factor X: Focus on cash flow scenarios and consider measures against cash flow outages. Add Factor X and monitor the financial reserve in cash flow.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.