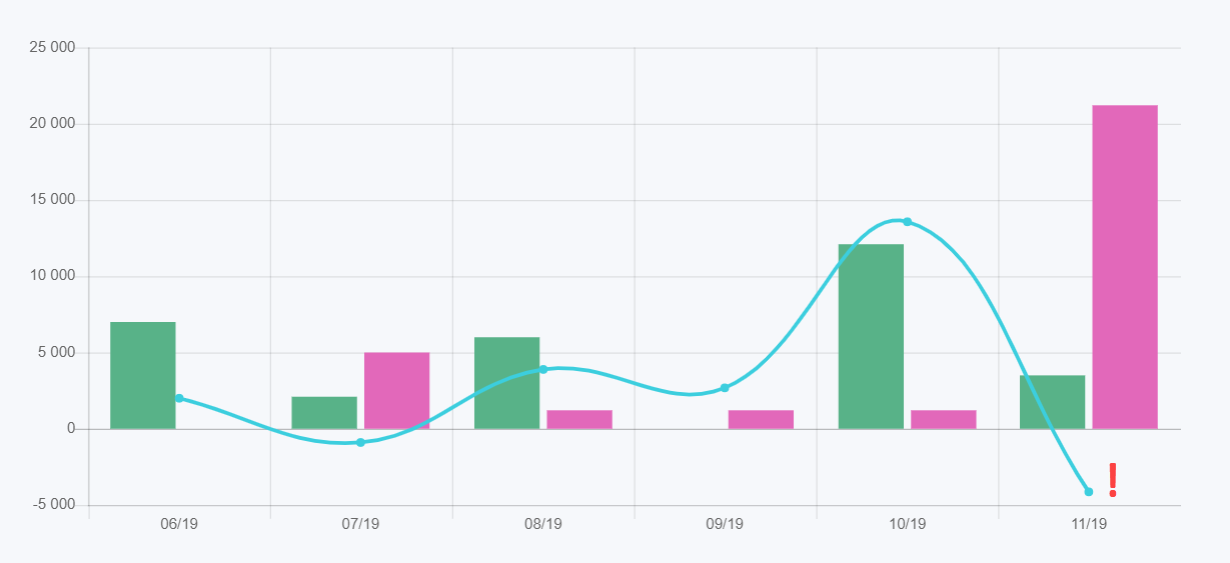

Many companies are already concerned about the impact of the incipient economic cooldown on their business. Less orders, less work, less money earned.

Many companies are already concerned about the impact of the incipient economic cooldown on their business. Less orders, less work, less money earned.

With the growing number of warning signs of a deteriorating world economy, more and more managers are asking the right question whether their company is in sufficient financial condition to cope with the consequences of the recession, or how best to prepare so that their company not only survives the economic crisis but emerge stronger from it.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

Evaluate your economic situation well in advance

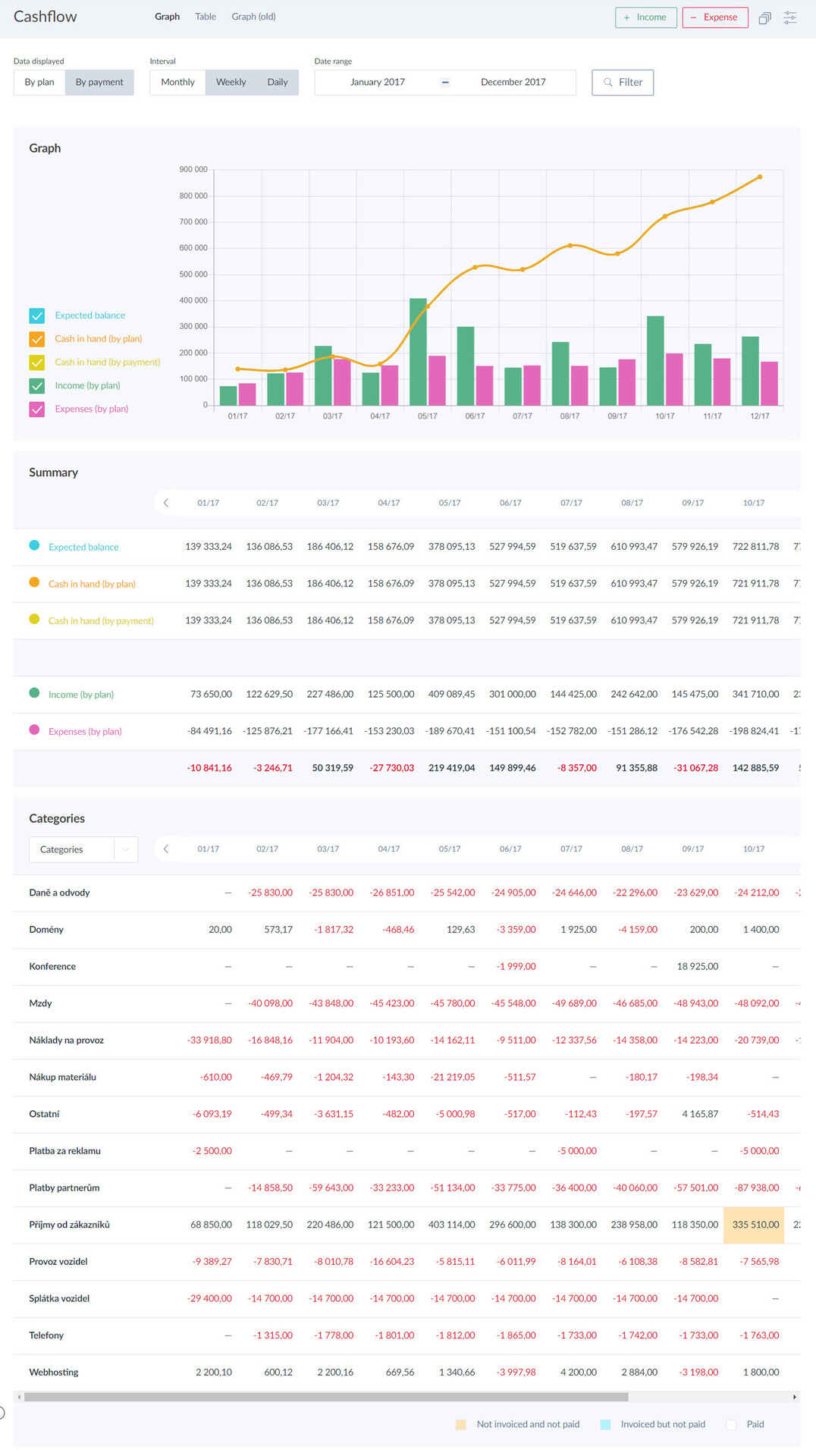

Cash flow management is the number one priority in times of recession. The most common mistakes with an impact on insufficient cash flow which companies often make are overcapacity and high mandatory expenses. The amount of the company’s assets should be in line with its performance. The growth rate of investments should not be higher than the growth rate of sales. The rule is based on the logical reasoning that the acquisition of new assets should be paid by the existing ones. At a time of expected decrease in sales and non-utilization of existing capacities, it is necessary to slow down the growth rate of investments and stabilize the situation.

Also review the regular costs associated with the company’s activities and assess them in relation to original expectations and current business prospects. Answer the question of whether the amount of costs associated with the use of external services set in the past is still necessary. These can be costs for the use of premises, fleet, costs related to banking services, or costs directed to areas that are not currently a priority for the company. After all, a successful company must not only be able to respond to market changes, but, to a large extent, it should also be able to anticipate them.

Also review the regular costs associated with the company’s activities and assess them in relation to original expectations and current business prospects. Answer the question of whether the amount of costs associated with the use of external services set in the past is still necessary. These can be costs for the use of premises, fleet, costs related to banking services, or costs directed to areas that are not currently a priority for the company. After all, a successful company must not only be able to respond to market changes, but, to a large extent, it should also be able to anticipate them.

Don’t wait until the fall of the market forces you to savings. They say that time is money. Many solutions are cheaper before you lose cash flow, before customers begin decreasing rapidly, and before it is no longer possible to negotiate extended maturity with the suppliers, and the conditions for obtaining credits are stricter as a result of the economic recession.

Strengthen what works

The idea of investing before the onset of the crisis seems intuitive. However, we do not necessarily mean the acquisition of real estate or technology, although if you have free resources, it is a good time to use them at a time when the economy is not doing very well, given the generally more favourable prices. In particular, the modernization of your operations, which will enable the production of more complex products with higher added value, may be the right tactic for competitive fight. But keep the growth rule above in mind.

Investing in strengthening a company’s competitive advantage can also take less costly forms. This could be, for example, improving the efficiency of processes or supporting training, which is among the first items on the list of deleted expenses at the time of crisis. However, reducing the volume of work is a good time to improve professional skills and strengthen professional knowledge. It is important to evaluate the impact of such expenses though. They should be directed where there is a reasonable expectation that they will pay off for the company in the form of expanded income opportunities.

Which employees are key to your business? You will probably want to focus more on those employees who are able to hold other positions and develop further. Constant training communicates expectations of constant improvement. Competent employees are more productive and efficient than their dependent, though perhaps cheaper, colleagues. If you are forced to reduce the number of regular employees, it will be the key people you will be able to rely on in times of crisis.

Avoid unnecessary efficiency leaks

Crisis often brings a decline in production. Production needs to be adapted to the temporary reduction in demand and at the same time prepared for further possible growth. Subsidizing production does not make sense in the long run. Proposals for streamlining everyday activities are very often made by ordinary employees themselves. Give them scope to express them. Ask your people regularly what you can do to make them work better in the following week. Pay close attention to their thoughts and transform as many meaningful ideas into common practice as possible. This will strengthen not only the company’s economy, but also the loyalty of the employees. According to statistics, engaged employees are more satisfied with their work, and this is reflected in stable performance, increased quality of the performed work, and ultimately in positive cash flow.

You can also do a lot to improve cash flow management by choosing the right accounting procedures and thinking about the appropriateness of setting up internal processes. Internal processes affect the need for working capital. By improving them, you can influence, for example, funds being unnecessarily tied up in the company’s operations due to chaotic administration of receivables or excess inventories of materials and unfinished work that do not correspond to the decline in sales. Insufficient or poor production planning also has consequences for cash flow. Therefore, pay attention not only to the actual management of production and production activities of the company, but also to its impact on the economic side of business and the connection with financial management.

Prepare sufficient financial reserves

As part of the company’s preparation for recession, we focused on the company’s production capacity and its key employees. However, the successful operation of the company has another important variable, and that is the amount of funds that will allow the company to survive even in more difficult times. It is wise to have a nest egg ready for a period when things go not as planned. Even in business, good times do not last forever, so it is reasonable to create reserves for worse times during better times. Own funds will also make it easier to obtain, for example, an operating loan or to negotiate an extension of the repayment of existing long-term debts. In a nutshell, a well-functioning company that has a clear plan for how to successfully survive a recession may not have any problems with financing.

So, don’t forget to continue to monitor, evaluate and actively manage your cash flow. 👉 For example with a smart business application CAFLOU®.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.