What is more important to you – profit or money? Most entrepreneurs focus on profit. Are you one of them too? However, do you know how the economic category of cash flow differs from the economic result? What can you find out from the income statement? Does bookkeeping really say whether a company really makes money?

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

Bookkeeping focuses on profits and losses

Have you ever wondered why so much attention in business is paid to profit when, without the ability to pay liabilities to suppliers and salary to employees, companies go bankrupt long before an unpleasant-looking loss appears in the income statement at the end of the year?

Entrepreneurs registered in commercial registers are usually required to keep the books by law. Bookkeeping is then used by the state to collect income taxes. However, bookkeeping as such is quite a cleverly designed record-keeping system. It is an ideal source of information about your company. It records what is bought, how is everything produced and how it is sold, who owes the company and to whom the company owes.

However, to evaluate the success of the business, bookkeeping uses the category of costs and revenues, the interpretation of which then decides on the published amount of profit or loss. You may be surprised that bookkeeping does not focus on payments and collections of money so much. How come?

Revenues and costs in bookkeeping

Revenue does not constitute immediate collection of money, as it is entered in the books when it is executed, regardless of payments. For example, you send the goods to the customer accompanied with an invoice, which states the date of taxable supply that determines when the revenue is entered in the books. The money will be credited to the company’s account at the time of payment for the goods by the customer. This can be in two weeks, in a month, but also later. That is at a time when the revenue entered in the books previously has long been part of the company’s past profit.

Similarly, a cost in the books does not necessarily mean immediate payment. For example, labour costs for the month of December are part of the economic result of the given year, however, the payment (and thus a reduction in cash flow) will usually not occur until January of the following year. In the acquisition of office equipment, computers, production lines, cars, buildings, etc., i.e. fixed assets in bookkeeping, payments usually live their own life, which is completely different from an accounting point of view. The value of purchased fixed assets does not become an immediate part of the economic result. Costs, referred to as depreciations, are entered in the books on the basis of a specified formula spread over a number of years, rather than on the basis of planned real-time payments for acquired assets.

Costs and expenses can thus differ diametrically in real life and in the economic result.

Money in bookkeeping

The fact that bookkeeping focuses primarily on income and expenses, regardless of the execution of payments, does not mean that money is completely omitted. However, this view is completely insufficient for the needs of the financial management of the company. The state of money in the company is kept in the asset accounts, which are combined in a statement called the balance sheet as part of the financial statement. Information on how much petty cash and money in the accounts the company has is entered for each specified period (usually the end of the year or the end of the month). Compared to the previous month, you can see an increase or decrease in money.

But the balance sheet does not show the movement of money. The “funds” item in the balance sheet will not tell you whether the money you used to expand the capacity arrived during the given period, whether this money was earned from sales of goods, products, or services, or if you drew it from a credit that will need to be repaid in the future.

Are you really making money?

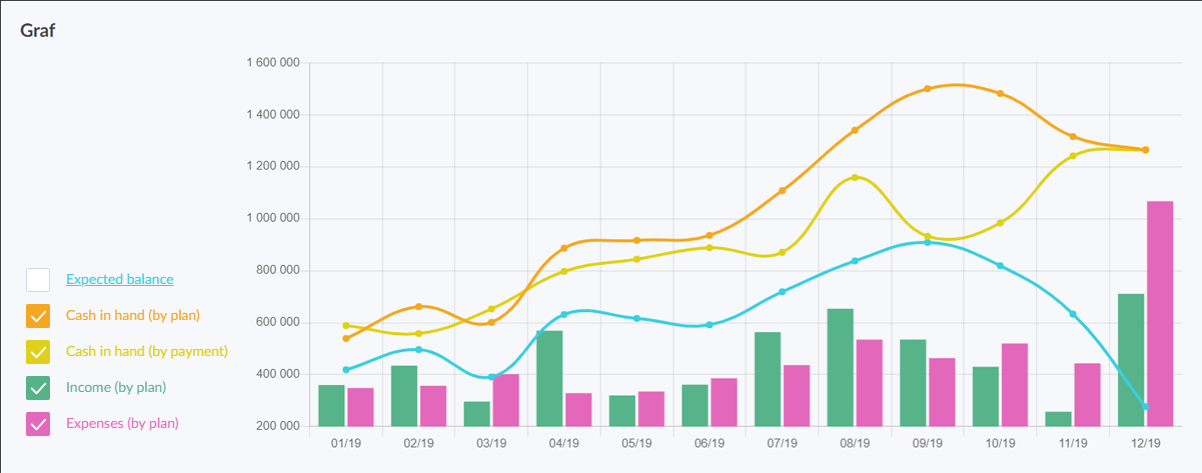

The income statement does show profit, costs, and revenues in the period in which they occur, but regardless of whether cash receipts or expenses are actually generated. Cash flow provides more accurate information about the economic activity of your company.

In order for financial management to be successful, it is basically necessary to know what generates money and what money is spent on. The profit and loss statement cannot say this reliably, as it contains the acquisitions and disposals of assets that are not always accompanied by cash movements (depreciations, capitalization, creation and use of reserves, etc.), and does not record the receipt of money from a credit or its disbursement (interests only).

Cash flow will show you whether you really earn money much more accurately and concisely.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.