Current market environment brings a number of risks that can significantly affect the achievement of planned results, be it financial risks, changes in exchange rates, commodity fluctuations, legislative changes or new technologies. Business owners and directors need to know what impact risks can have on the company’s economy. There is a solution in the form of a risk-based financial model.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

Taking risks into account during financial planning

Are you preparing for several scenarios in your cash flow plan? If your answer is no, for example due to a time burden that you cannot afford, we have an interesting piece of information for you. The time spent preparing an optimistic and pessimistic variant will pay off many times over thanks to the savings of the managed risks, which are associated with key areas of your activity, such as the volume of sales or the purchase price of basic inputs. To be able to estimate how much money you will need and for how long it will be needed with a high degree of probability, you need to find the potential risks of deviations from your cash flow plan.

For example, when selling abroad on a trade credit, the entrepreneur bears a number of risks based on the choice of the country to which the invoiced goods and products are delivered, risks associated with the choice of business partners to ensure transport, or currency risks associated with exchange rate fluctuations. You can manage the exchange rate risk, for example, by preparing a cash flow plan for all projects in foreign currencies and arranging the exchange rate after signing the contract. This proves useful especially when the Czech currency strengthens; without arranging the exchange rate, the project would be damaged by a reduction in receipts in the Czech currency if it strengthened.

Knowledge of the cause of risks increases the effectiveness of liquidity management

First, you need to find the cause of the risk. Above all, the risk must be correctly understood so that you can correctly estimate its size and then set the appropriate strategy for the procedure. However, do not get confused by the current impact of the risk. Look for the root cause. Finding the cause may be more laborious than simply identifying the risk, but a deeper analysis will pay off in the form of greater effect through risk management in case of risks with a serious impact.

For example, you have identified a potential threat to cash flow plan fulfilment due to late payments from your major customers. To find possible causes of such behaviour of business partners, it is recommended to perform a financial analysis.

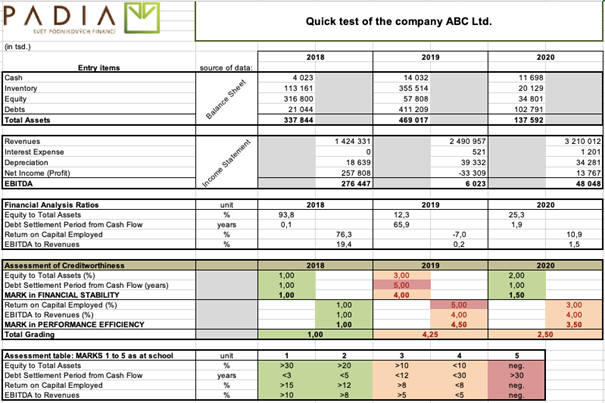

On the basis of a quick test of creditworthiness based on an estimate of the company’s financial stability and performance based on some data from the financial statements, you can mark your business partners from one to five and pay attention to those marked four and five, i.e. companies potentially unable to pay.

The risk of late payments from customers, which are caused by their serious financial problems, indicates a high degree of threat. Therefore, actively request to hand over the goods in return for a deposit, or manage this risk otherwise. If, on the other hand, there would be a risk of a late payment from a financially sound customer, where the possible impacts are orders of magnitude lower, it would be enough to improve cash flow by regularly monitoring overdue receivables and setting an automatic reminder system.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.