In the first part of a new series on corporate finance, or more precisely cash flow, we have introduced cash flow as the most important indicator of the economic success of any company.

Insufficient cash flow is the most common cause of business failure. Therefore, manage and plan company’s cash flow so that you do not get into the sad statistics of failing companies.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

The cash flow statement by operating, investment and financial activities will answer questions such as how the company invested, paid out profit shares and especially how much money the operating activities brought to the company. Objective monitoring of income and expenses serves to assess its financial health. Another aspect, no less important for a company’s ability to survive, is the evaluation of the timing difference between income and expenses.

Tracking company’s bank statements does not necessarily mean keeping a company’s cash flow under control. The key to successful management of company’s cash flow is the ability to anticipate the impending difference between the company’s income and expenses. Cash flow therefore needs to be planned in advance. If you are wondering why you should spend time and effort managing cash flow when you have profit and loss statements from accounts, we remind you that accounting costs and revenues do not take into account the time when payments are made and collected.

Every entrepreneur should keep track of their own plan of income and expenses. Thanks to it, you can more easily monitor the payment of received invoices and other liabilities of the company at the time of their maturity. With the cash flow statement, you can more easily plan the company’s development and investments so that the company does not get into financial problems due to a lack of funds. Information on sufficient cash flow is also necessary when repaying credits and meeting bank conditions.

How to plan cash flow?

First, gather the necessary inputs. Your cash flow planning will be based on the balance of money in the company’s accounts and treasury, overviews of invoices with expected maturities, business case prospects, payroll dates, payment of social security and health insurance contributions, taxes, credit repayment dates and other regular expenses.

Some inputs in the cash flow plan will apply to the entire planned period and others will need to be updated each time you work with cash flow. These inputs requiring active work with data are mainly receivables and payables, or more precisely issued and received invoices. However, their values can be easily generated in common accounting software or invoicing programs. The balance of the bank account or treasury will also require a monthly update.

By contrast, payment calendars, monthly payrolls, regular payments of taxes and social security and health insurance contributions are among the inputs that can be planned with high accuracy, say for half a year or a year in advance. They will then figure unchanged in the cash flow plan throughout the planned period, except for moments when there will be significant changes. These are, for example, taking out a new credit, increasing the overdraft facility or deciding on a salary increase, when you must change them in the plan. Similarly, planned investments are entered into the cash flow plan only once in a while.

Excel or applications?

If you already have an idea of the inputs to the cash flow plan, the question arises how to put them together so that rewriting the inputs to the cash flow plan does not take too long. An ideal tool is one where you will keep a record of the incoming and outgoing transactions, distinguishing between completed and planned ones. Spreadsheets such as Excel will allow you to keep recurring information about advance payments or payroll payments in the expected amount. In Excel, you can also use formulas to automatically calculate expected invoice payment dates according to defined maturities. In addition, Excel can be linked to invoicing or accounting software thanks to macro programming.

If you already have an idea of the inputs to the cash flow plan, the question arises how to put them together so that rewriting the inputs to the cash flow plan does not take too long. An ideal tool is one where you will keep a record of the incoming and outgoing transactions, distinguishing between completed and planned ones. Spreadsheets such as Excel will allow you to keep recurring information about advance payments or payroll payments in the expected amount. In Excel, you can also use formulas to automatically calculate expected invoice payment dates according to defined maturities. In addition, Excel can be linked to invoicing or accounting software thanks to macro programming.

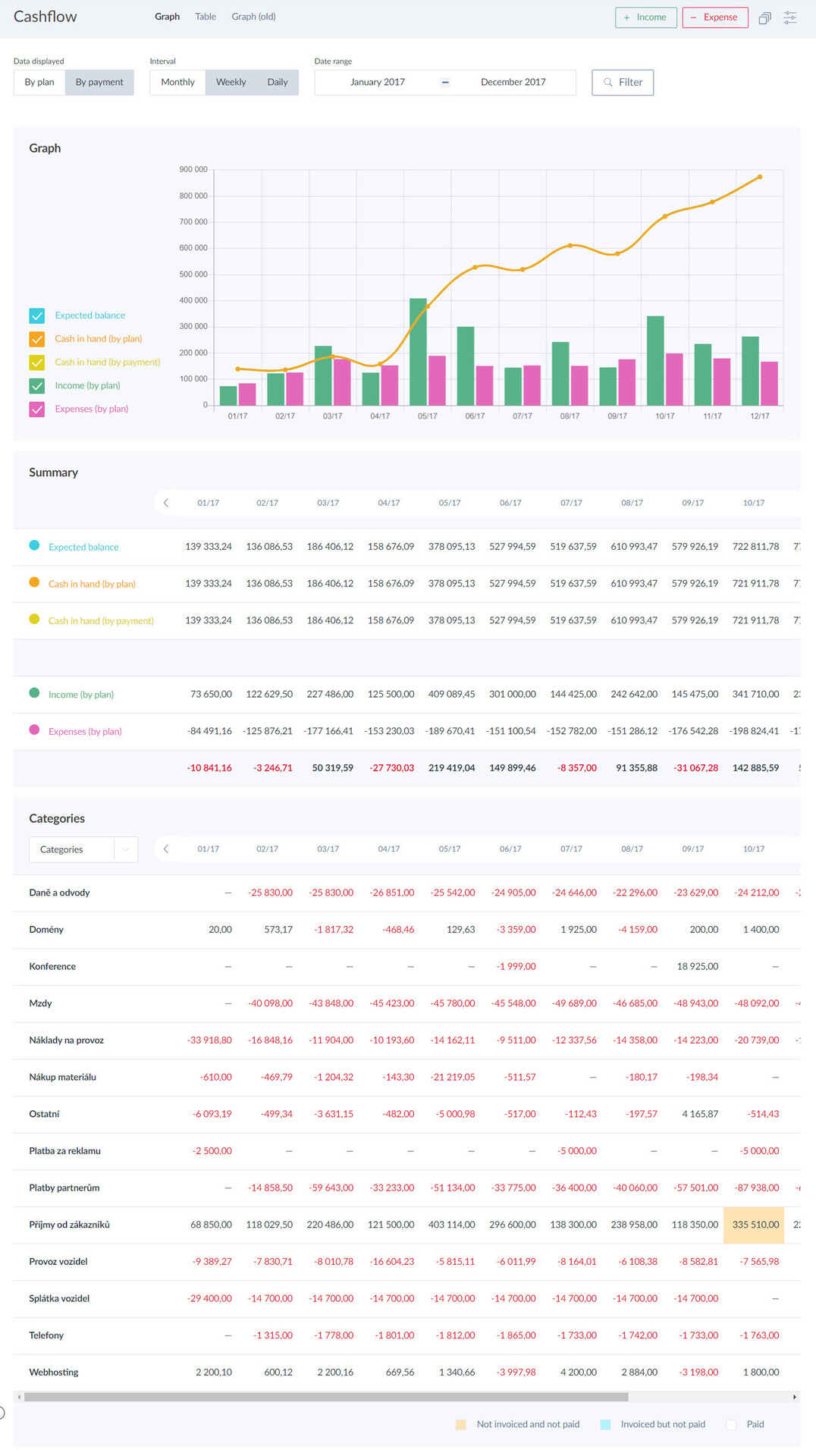

If you concentrate your inputs in a single information system that can work with them, you will avoid surprises regarding cash flow, as all significant expenses, as well as most likely planned income from key customers, are known in advance.

A good information system will do a lot of work for you. However, it is necessary to plan not only the real development of cash flow, but also an estimate based on possible developments. A division of the outlook into realistic, which includes only invoiced activities of the company, and probable on the basis of incomes from regularly invoiced activities that are yet to be invoiced, or future already known ad hoc orders, could be good for your orientation.

In addition, it is recommended to plan a variant where everything will not go as planned. For example, if you don’t receive enough orders, the performance of the order takes longer than expected, the delivery of material is delayed, and that which is available from another supplier is more expensive, you are slowed down by machine downtime, etc. In the pessimistic variant, only plan the payment of the necessary expenses, and you can, in advance, consider deferring payments to those business partners who are likely to grant your request.

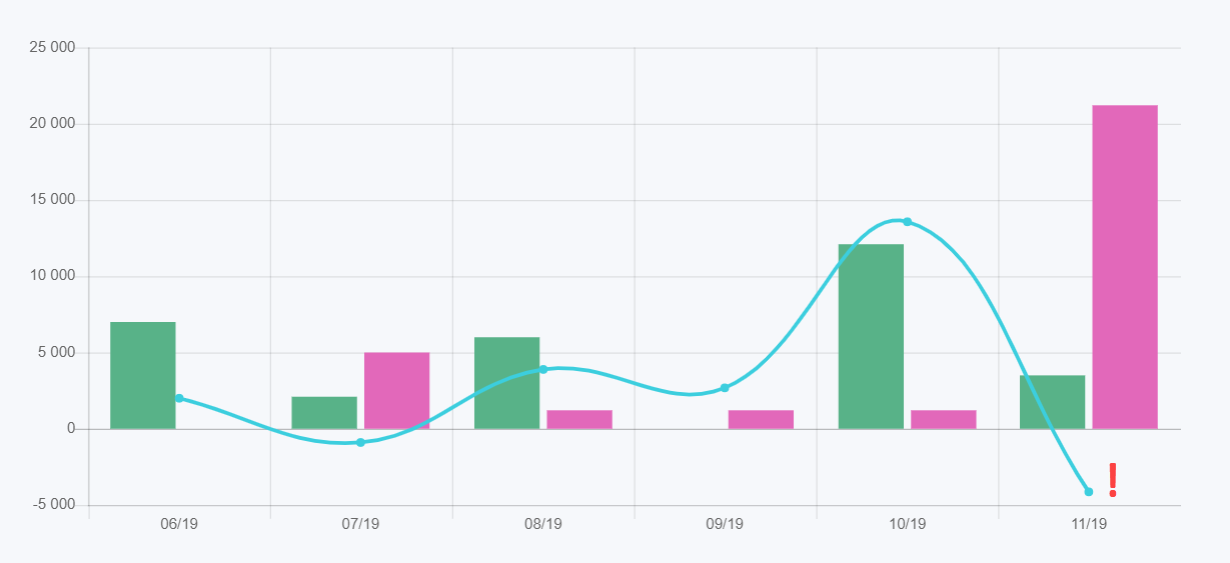

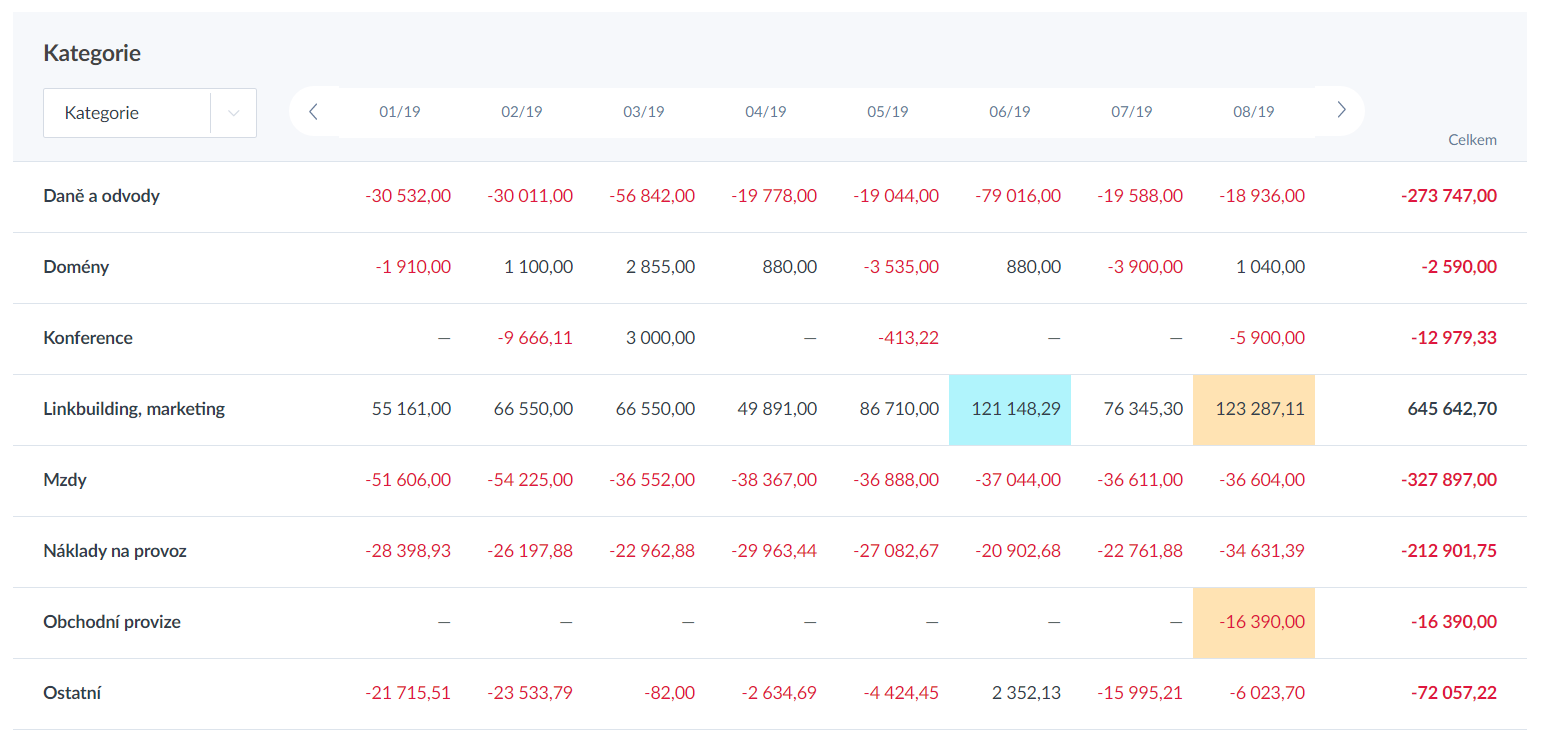

Appropriate cash flow management and planning software makes it easier to work with variant planning, as they can record potential sales according to the probability of their implementation, including the deadline and payment terms, or even incorporate customer payment morale into the cash flow plan based on their payment history.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.