Various tools are used for cash flow planning and analysis in companies around the world. A good cash flow plan needs not only income and expenses to be taken into account, but also the correct timing of the due date of issued invoices, payrolls and other payments with the due date of received invoices. Because the amount of money collected fluctuates more or less irregularly, the right tool is needed to enable the company’s management to act in a timely manner. Get inspired to choose the tool that works best for your business.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

Reliable cash flow planning is a source of competitive advantage. However, common accounting programs can determine the cash situation both as of the current date and retrospectively. It is important for company managers to be able to verify whether the company has enough funds to pay the company’s liabilities to suppliers, employees or banks also in the future. Therefore, cash flow forecast is one of the most important managerial tasks for most companies. It is necessary to plan not only the real development of cash flow, but also an estimate based on the development of further actual functioning of the company.

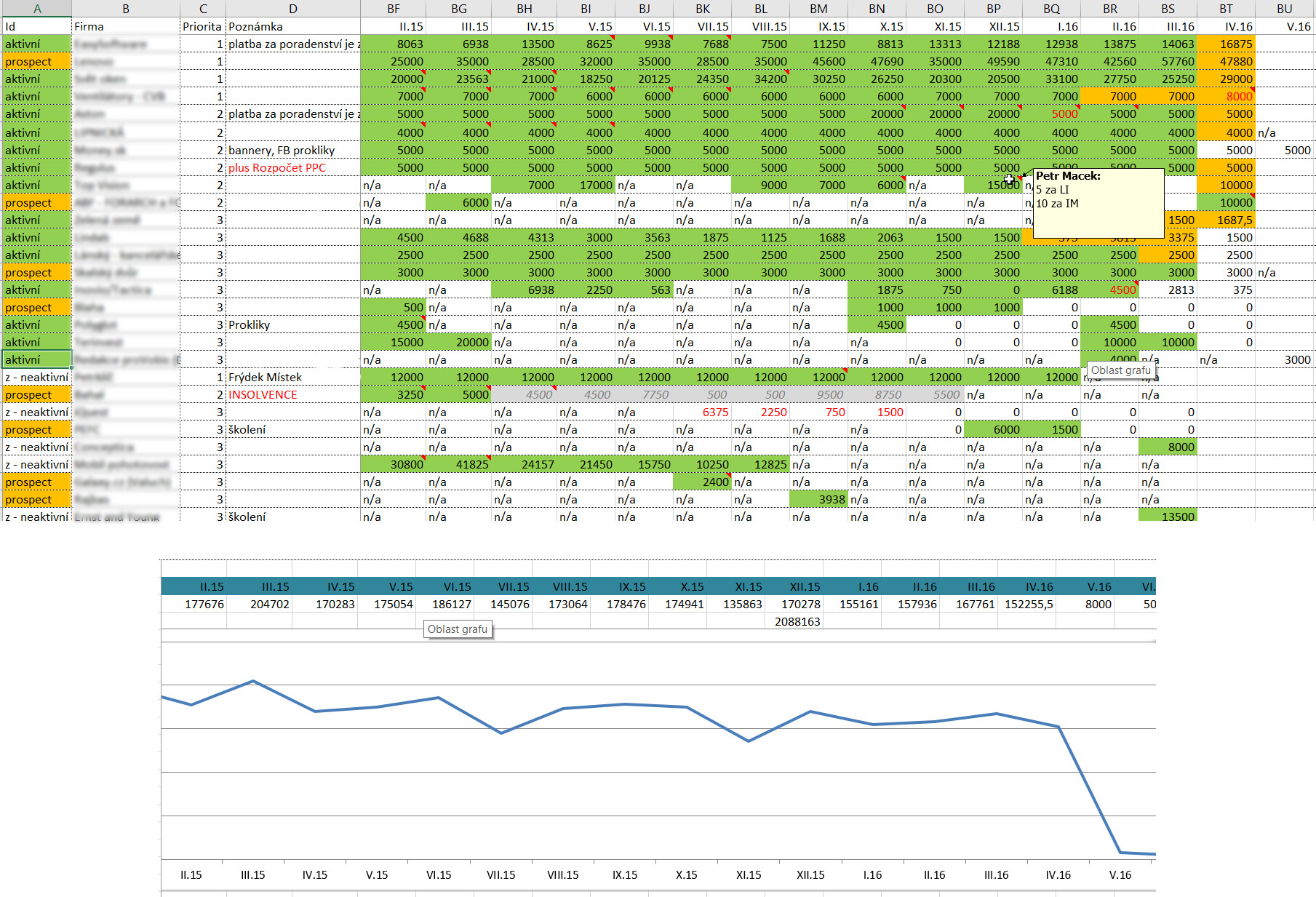

Pencil and paper or Excel

Micro companies can work without a more complex cash flow prediction model, because the owner of such a company can calculate everything needed on paper. However, as soon as the company starts to grow so much that it is no longer possible to find out what the expected balance of money in bank accounts will be in, for example, 7 or 14 days with simple calculations, it is necessary to start predicting cash flow using software or a model.

The use of spreadsheets such as Excel comes in mind. These will allow you to keep record of recurring information about advance payments or payroll payments in the expected amount. In Excel, you can also use formulas to automatically calculate expected invoice payment dates according to defined maturities. Thanks to macro programming, Excel can also be connected to invoicing or accounting software (which, however, goes beyond the usual knowledge of working with Excel). However, it is a stand-alone tool that you need to keep up to date (which is laborious in case of more complex scenarios). With the growing volume of managed data, the growing complexity of the plan and the growing number of users of the financial plan, it is necessary to take into account other potential problems. It is not the goal of financial planning to spend time importing, exporting, and handling data. On the contrary, it is better to use the time to utilise the cash flow plan statement.

ERP and BI

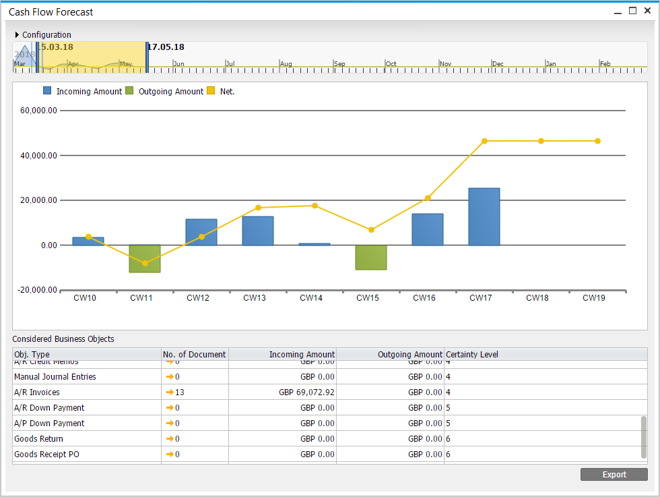

The preparation of financial plans is very difficult for many companies. It often involves time-consuming calculations. Manual preparation of a financial plan is not only laborious, but important connections can often be omitted. This leads to a reduction in the quality of the plan. Simply put, cash flow management with documents prepared only in Excel lacks an extremely important feature. And that, in addition to reliability, is speed. However, managers have more options than just spreadsheets such as Excel, LibreOffice, Google Sheets, or OpenOffice. When creating a cash flow plan and using it for management, it is advantageous to concentrate the inputs into one information system that can work with them. There are systems on the market offering a sophisticated relational database for data storing and processing, and a multidimensional database for storing the final data displayed by the model. Could it be accounting software?

The preparation of financial plans is very difficult for many companies. It often involves time-consuming calculations. Manual preparation of a financial plan is not only laborious, but important connections can often be omitted. This leads to a reduction in the quality of the plan. Simply put, cash flow management with documents prepared only in Excel lacks an extremely important feature. And that, in addition to reliability, is speed. However, managers have more options than just spreadsheets such as Excel, LibreOffice, Google Sheets, or OpenOffice. When creating a cash flow plan and using it for management, it is advantageous to concentrate the inputs into one information system that can work with them. There are systems on the market offering a sophisticated relational database for data storing and processing, and a multidimensional database for storing the final data displayed by the model. Could it be accounting software?

Entrepreneurs are obliged to keep accounts and do so mostly through accounting programs. So why not use an accounting system when it contains almost all the data needed to predict cash flow? Advanced accounting programs usually include various extensions or simplified reporting. But accounting systems are not the same as ERP (Enterprise Resource Planning) systems. The first ERP system was SAP, which is still the best-selling one worldwide. You can choose from many other ERP systems, which differ, for example, by how large a company they are intended for or in which industry the company operates. ERP systems offer everything that every accounting program offers, plus they integrate, automate, analyse, monitor and allow you to effectively manage a large number of other processes, which are often tailored to the activities of a particular company or are personalized according to user roles. ERP has two main advantages over non-integrated systems. It offers a unified company-wide view of everything that takes place in different divisions, and a common company database combining and storing all company data. Advanced management reporting using Business Intelligence (BI) is one of the basic characteristics of ERP systems.

Smart applications

A good information system will do a lot of work for you. With the help of technologies, you can simplify many things in the company, from invoicing, through customer support, project management, sharing documents with colleagues, to increasing the overall efficiency of company activities, for example through various workflows or with automation.

A good information system will do a lot of work for you. With the help of technologies, you can simplify many things in the company, from invoicing, through customer support, project management, sharing documents with colleagues, to increasing the overall efficiency of company activities, for example through various workflows or with automation.

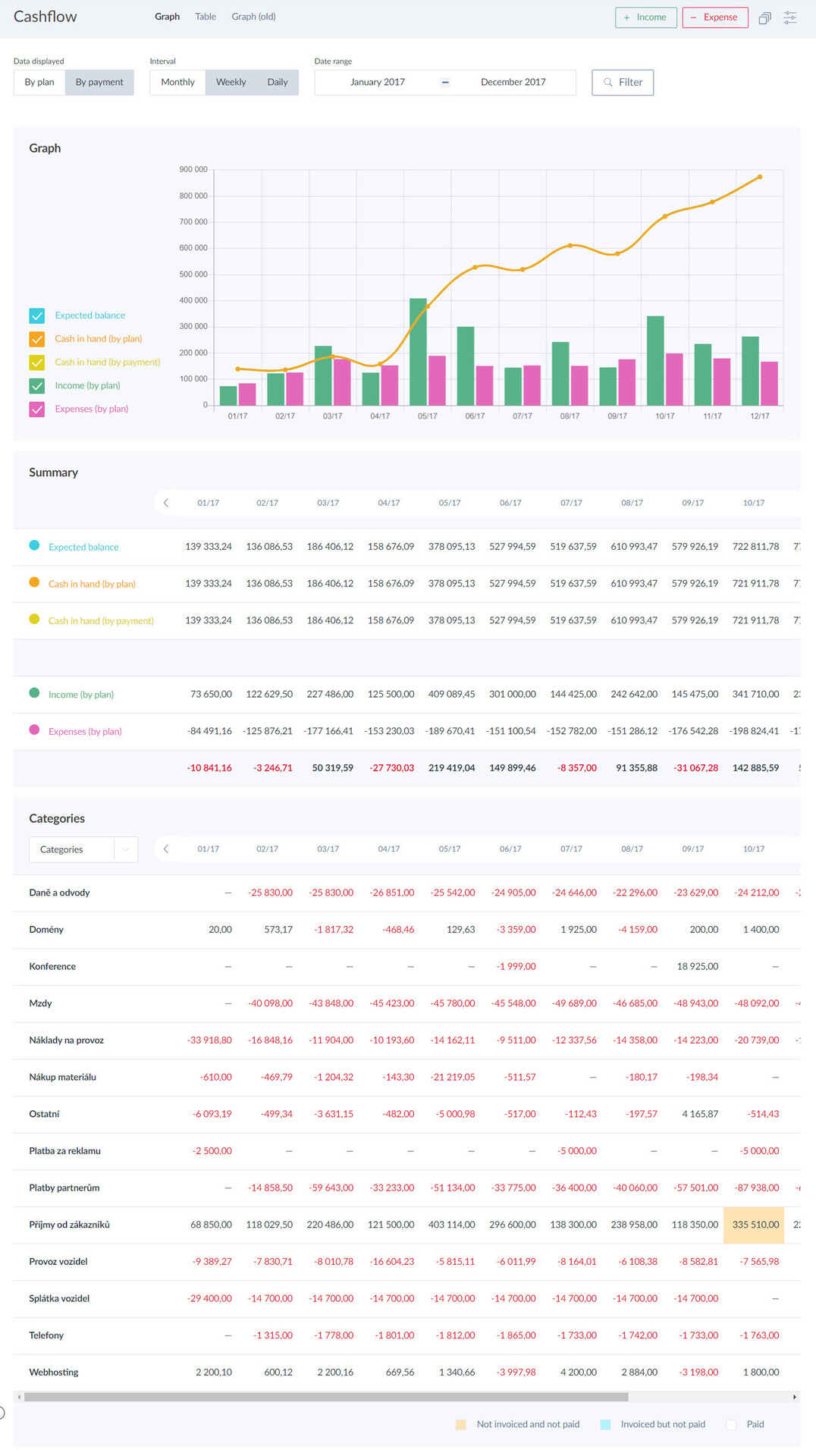

Unfortunately, overly complex ERP/BI programs can be challenging for a company both in terms of budget requirements and time for their implementation. If you are dissatisfied with the shortcomings of Excel and the expensive ERP/BI solution is an overkill in your situation, you may like specialized applications for financial management or simpler business management systems also focused on economy (and cash flow).

There are software solutions available on the market specialized in cash flow management and planning or offering cash flow management as a full-fledged module that logically fits into other company processes (e.g. invoicing, project management, time sheets or CRM). In addition to the cash flow forecasts and analyses, these systems also allow for an elegant visualization of the future development of free cash flow when various parameters are defined, usually not only for the company as a whole, but also by customers and suppliers, projects or other activities. An indisputable advantage at a relatively low cost is the automated processing of the data needed to compile a cash flow plan, which thus provides data in real time. Such smart applications are a tool that allows you to focus on planning, modelling new business opportunities and increasing performance. With cash flow management and scheduling software, you save time on error checking, data collection and process coordination.

💡 Thanks to the CAFLOU Academy, you know that you can also plan cash flow in the smart business management app CAFLOU®. It allows you to see the income and expenses for each customer and supplier. You can also monitor cash flow according to projects (contracts) or divided into actual and estimated cash flow. CAFLOU will make your work with the preparation of the cash flow plan and its variants easier thanks to the possibility of recording potential sales according to the probability of their implementation, including the deadline and payment terms, or by incorporating the payment morale of customers based on their payment history towards you. Thanks to the possibility of connecting cash flow with the bank, you can see whether your invoices have been paid to the customer. You don’t have to install anything, because it can work seamlessly online on both desktop and mobile.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.