See how to automatically extract data from your (received and issued) invoices directly in Caflou using artificial intelligence and automatic extraction and thus save time when recording invoices (e.g. as data source for accounting or for cash flow management or approval of invoices).

⏱ To record received and issued invoices, you do not have to rewrite invoices manually, just upload the invoice* and the system will "overwrite" it for you. This saves a few minutes of time on each invoice (= also money 💰) and reduces possible errors (e.g. when rewriting amounts, account numbers, reference numbers, etc.) ⤵️

What to consider:

- 🔐 Invoicing via artificial intelligence (AI) is now in beta = the function is accessible and functional, however, it is being fine-tuned and improved on an ongoing basis, and errors may occur.

- ❗ There are thousands of invoice forms and templates. The system is gradually learning and it must be taken into account that not everything can be extracted properly at first. Some invoice templates will never be retrieved correctly (e.g. if the data is unclearly structured or the invoice template cannot be converted to CAFLOU invoicing logic). That is why it is necessary (at least in the beta phase) to check the correctness of extraction.

- Therefore, each extracted invoice goes through the "concept" phase, which requires control, see the video above.

- When editing the concept, at the same time you can associate the invoice with a project or task, add a tag or create an income or expensefor Cashflow under the invoice.

- ✉ If you find an inconsistency, please fill in the error form directly in the invoice concept.

- ❗ Entering invoices iton Caflou has its own specifics, just like entering invoices in any other invoicing system. The extracted document is adapted to these specifics of invoices in Caflou, the key are the main data from the extracted invoice (e.g. amounts, VAT, currency, due dates, issue date, tax date, counterparty company data (name, address, ID number, VAT number, account number), etc. ), which can be taken over from invoices, however, the document extracted in this way in Caflou may look a little different, everything may not be 1 to 1. Data needed for accounting and data needed for payments or cash flow are important.

- If the invoice contains your company (as a customer or supplier), the system will classify it accordingly as received or issued invoices (depending on whether you are a customer or a supplier). If the system is unable to identify your business, it will consider the invoice as received.

- ❗💰 The invoice extraction function itself is above standard and will be charged in addition to all paid plans.

For each withdrawal (above (any) free volume) the credit will be deducted.- A credit higher than 0 USD/EUR/CZK is required to use the function.

- For extracting each one page of the document 0.19 $ or 0.16 € or 4.00 CZK* (based on your billing currency, excluding VAT) will be deducted (credit will be deducted when the invoice concept is created).

* Theprice for each extraction can change.

💡 TIP 1

You can also send invoices for extraction as attachments by e-mail. How does it work? Just send e-mail with attachement(s) to your-account@extract.caflou.com. Replace the "your-account" portion of your email address with your account name, follow these steps:

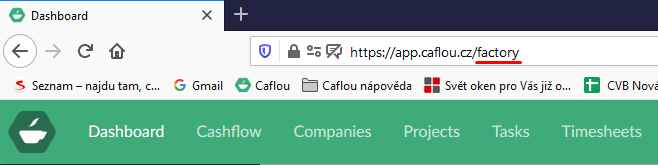

It means for the account "Factory" is the www address of the account in Caflou app.caflou.cz/factory (or app.caflou.com/factory) and the e-mail that you will use for extraction is factory@extract.caflou.com

Only an account user who has the special access rights to "Documents" and at the same time the right to "write" to unassociated files can extract an invoice by e-mail. Caflou will verify such a user by e-mail (the e-mail of the sender of the request matches the e-mail of one of the users of the account).

❗ By sending an e-mail to your-account@extract.caflou.com you confirm that you understand the principles of the invoice extraction function (as described in this help article).