If you think about it, nearly every professional is involved in cost management in some way. We have to make decisions around pricing, expenditures, financial forecasting, financing and debt, and more – cost-related decisions affect people at every level of your small business.

So, whether you’re a manager, senior executive, or a small busin derstand effective cost management to track and calculate costs and to manage accountabilities. In this article, we’ll explore what this means in practice, and how you can manage costs effectively while ensuring accountability.

🎓 Caflou academy is brought to you by Caflou - 100% digital business management software

What is cost management?

Cost management involves using cost accounting processes to guide present and future operations towards specified goals. It helps you identify, plan, analyse, and ultimately control the costs associated with running your business.

You can break cost management further down into two levels:

- Business cost management, which covers the economics of your entire business, including budgets, expenditures, payroll, resource costs, etc. By introducing a centralised system that manages, monitors, and helps you control your business costs, you’ll have a complete view of cost structures, spending, cash inflows and outflows, fueling more informed decision-making.

- Project cost management, which involves estimating, planning, and controlling expenses throughout the project life cycle. Tracking and managing costs at the project level gives you more granular insights into your business’s economics, helping you better manage finances and ensure that individual projects are profitable.

Why should small businesses invest in cost management?

While waste is bad for businesses of any size, small businesses in particular can’t afford inefficiencies and wasted resources. Given that a third of small businesses are potentially facing bankruptcy caused due to negative cash flow, managing expenditures is crucial to your company’s survival.

A business cost management system will help you:

1. Establish and stick to budgets

If you’re running your small business without scrutinizing budgets, cash flow, and costs, you’re at risk of becoming one of the 50% of small businesses that don’t make it past 5 year mark. While many factors may contribute to a small business’s cash flow problem, ineffective cash flow management is a common one. But with the right systems in place, you can manage costs and ensure a healthy, sustainable cash flow.

One of the most important ways to manage your costs is to introduce budgets, which may vary across different departments, teams, and business functions. And while each business function may have autonomy over its expenditures, it’s really important to centralise your cost management and track your entire organization’s economics.

That’s why Caflou lets you monitor and manage “global” budgets across different departments, like HR and marketing. Centralisation is crucial to monitor productivity and understand where money is coming in, and where it’s being spent.

2. Allocate funding based on cost estimations

Overspending has obvious consequences for any business, but don’t overlook the possible drawbacks of underspending. If you implement budgets that are too restrictive, you risk limiting your employees and their available resources, negatively affecting growth and productivity.

That’s why, during the financial planning phase, you’ll need to accurately estimate costs based on your organisation’s needs. For example, if you’re implementing budgets for different departments, talk to your department heads and managers to understand what resources they need, what expenses they have, etc. And budget accordingly.

To better understand the nature of cost estimation, let’s consider a more granular example. Let’s say you’re interested in launching a new product and you need to identify the expenses involved. You can obtain a fair cost estimation by accounting for:

- Research and development costs, which include market research, product design, and prototyping cost.

- Manufacturing costs, including the cost of material, labor, and production infrastructure.

- Marketing and advertising costs, including the cost of marketing collateral and any paid campaigns.

- Shipping and distribution costs, including the cost of shipping products to retailers or end customers.

- Costs of any delays or problems that arise.

3. Ensure profitability

Businesses need capital to grow, but securing funding for your small business can be difficult. But whether you have a strong financial cushion or not, making sure your customers/accounts, projects, and business overall are profitable is essential. Your revenue numbers might look nice, but if your business isn’t profitable, you’ll run out of cash.

So when you’re evaluating your business’s profitability, get as granular as possible. Scrutinize individual projects and measure their profitability, analyse your clients/accounts and make sure they’re profitable for you too. Additionally, it helps to identify your most profitable customers, because it’s vital to retain these accounts.

4. Improve cash flow management

Cash flow is simply the difference in your company’s income and expenses, and calculating your cash flow reveals important insights – which can be quite nuanced. Intuitively, a very low or negative cash flow is an indicator of poor financial health – it might mean that your business is struggling to produce timely income. However, a very positive cash flow isn’t necessarily ideal either – it could mean your business isn’t investing enough in new assets or technology.

So, to make sure your business has a healthy cash flow, you’ll want to scrutinise your company’s cash inflows (where money is coming from) and outflows (where it’s being spent/going out). Additionally, it’s a good idea to invest in cash flow planning to make sure you have enough cash reserves for long-term growth. Over 61% of small businesses, a recent study from Inuit found, struggle with cash flow, and 32% (a third) are unable to make vendor payments, service debt, or pay themselves or their employees. So planning ahead is crucial.

8 Tips to streamline and improve your cost management

Looking to improve the way you manage your costs? Here are some steps you can take today.

1. Lay out current, historical, and future data

Data is arguably the most valuable asset for any small business that aspires to become a going concern. Current and historical cost data can help identify areas where your business may be over or under-spending. You can leverage this information to discover opportunities for reducing costs and improving growth.

By predicting future trends and performance, you can also make more informed decisions about investments, expenses, and resource allocation. For example, you can leverage financial projections to make decisions related to budget allocations, investments, and raising capital.

But to have the right data on hand, you’ll need to make sure you document it as you go along (financial documentation is also required for regulatory compliance), either in Excel/Google Sheets or by using an accounting/business management software. If you use software, you’ll have access to real-time data and automated financial reporting.

(P.S. Learn more about choosing the best business management system for your needs here)

2. Understand your organisation’s operational and management needs

Earlier, we stressed the importance of setting realistic budgets. You need to know what different departments need to help them function smoothly and access the resources they need. Talk to your teams to understand what resources they need, where they need them, when and why. You’ll want to learn as much as you can about their resource requirements to help identify potential waste and to ensure resources are used efficiently.

Additionally, understanding resource requirements will also help you prioritise budget allocations. For example, let’s consider a marketing team or department that wants to run a Facebook Ads campaign for a new product line.

Before you approve the budget for the campaign, you’ll need to make sure that your business has the resources to cover logistical and operational needs, like manufacturing the products, storing, packaging, and shipping them, etc. After budgeting for the essentials, you can proceed to allocate a budget for the advertising campaign.

3. Set realistic targets

Unless you measure performance accurately, you can’t be sure of where your business’s health stands and how much risk your business has assumed. And setting realistic targets is essential in measuring your performance accurately – but how do you make sure your targets are realistic?

Well, one possible way is to follow the SMART criteria, which advises you to set goals that are specific, measurable, attainable, relevant, and time-bound. You can break these goals further down into smaller milestones to track progress, which will help you identify inefficiencies on a granular level.

For example, let’s consider how a marketing agency might break down a SMART goal into smaller tasks. Let’s say their SMART goal is to “achieve 20% organic growth in website traffic within 2 months”. Now, we can break it down into smaller tasks like:

- Conduct a website traffic analysis to set a baseline for measuring progress, and also to identify areas for improvement.

- Optimize website content based on the analysis results, including improving site speed, optimizing content for search engine (SEO), and backlinking, etc.

- Develop and implement a content marketing plan, including creating and publishing X number of blog posts, creating social media content and setting a distribution frequency, and setting up email marketing sequences, etc.

- Lastly, monitor website traffic metrics i.e,. Unique visits, time on page, sessions on page, etc., to get an accurate picture of whether you are on track towards your goal.

Additionally, for each project, it’s important to account for potential risks (and the costs of responding to them).

4. Track resource allocation and consumption at the project level

We’ve talked a fair bit about the importance of tracking costs at the project level, but what does this mean and practice, and how do you do it? Well, here’s more on what you’ll need:

- Planning resource management, which includes project-related expenses such as equipment, supplies, and travel costs, to ensure that projects are staying within budget. It is good to have expense tracking software that helps streamline the process and provide a clear overview of the costs associated with your projects.

- The project work schedule. This includes an estimated timeline for initiating and completing your project’s milestones, work packages, and activities. Additionally, after starting your projects, you’ll want to track how much time is spent on each project, so you can evaluate your team’s productivity for each project.

Salaried employees are paid for their time, so you need to factor their productivity and efficiency into your cost calculations. Make sure your employees aren’t spending too much time on less-profitable projects at the cost of more profitable ones.

- Cost management plan. This will include a breakdown of how your costs are structured.

- Potential project risks, and the costs of responding to them.

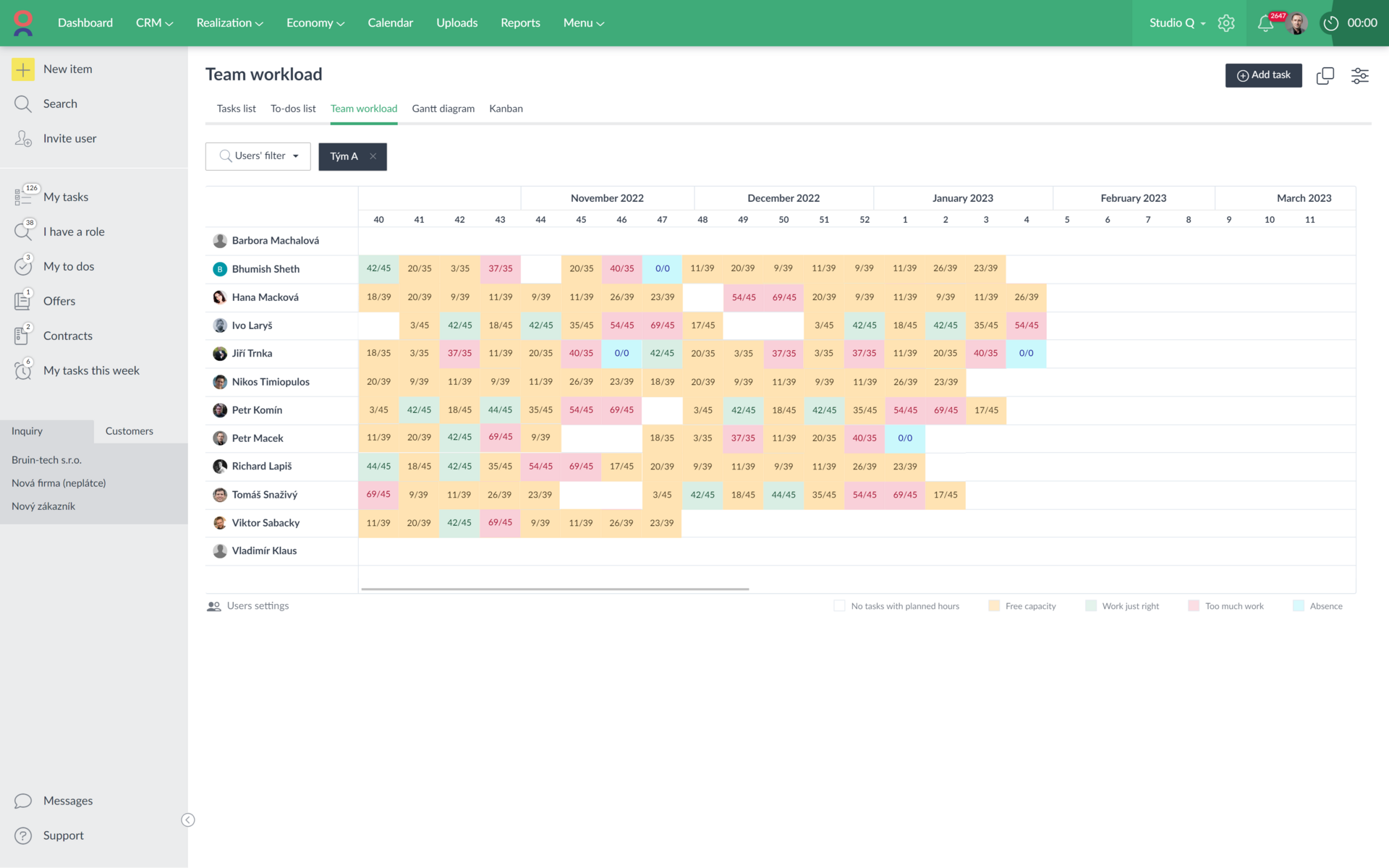

To help you accurately track project timelines and resources, you might want to use project management software with advanced features like cost management and budgeting. It’ll give you a centralized platform for tracking the progress of all your projects from one place, so you’ll have a complete overview of all your projects and their related costs.

5. Assign responsibilities and hold people accountable

Without clearly defined roles and responsibilities, your team members won’t be clear on what results they’re accountable for. Moreover, you’ll find it difficult to hold someone responsible when business goals aren’t met, because ownership of those responsibilities isn’t defined.

When employees know that they’re responsible – and accountable – for specific tasks or results, they can focus on delivering. You can cultivate a sense of accountability by:

- Defining roles and responsibilities for each employee, making it clear what tasks they are responsible for and what is expected of them.

- Setting a clear set of goals against which the responsibilities will be adjudged, i.e. deadlines, quality standards, and other performance metrics related to your business.

- Providing training and support to employees to equip them with the necessary skill set that allows them to do their job effectively.

- Using performance appraisals to hold employees accountable for their performance and outcome. This will set up a culture where good performance is rewarded, and employees will feel motivated to perform better.

6. Analyse profitability at a granular level

Analysing the profitability of your projects and customer accounts helps you better manage your resources. It’s important to limit the resources you spend on projects that offer minimal profits, and you’ll want to avoid projects that aren’t profitable at all. To determine a project’s profitability, you’ll need to account for both the direct (materials, labor, facility) and indirect costs (administrative expenses, overhead costs) associated with each.

7. Leverage cost management software

If you use dedicated accounting software, or a solution (like Caflou) that supports cost management, you’ll be able to efficiently track and manage your entire business’s economics in real time. Cost management software lets you:

- Automate tracking and reporting of expenses, allowing you to monitor the costs and profitability.

- Identify cost-saving opportunities, by highlighting areas where costs are high or where expenses can be reduced.

- Get real-time data on expenses and revenue, allowing you to make more accurate financial projections and better plan your budgets.

- Improve cash flow management by providing a holistic view of expenses, financial obligations (debt servicing), and revenue flowing in. This can help you make key decisions about when to pay bills, when to invest in new initiatives, and when to hold off on spending.

- Reduce error and fraud by providing an automated approval and controlling processes making sure that every transaction goes through the proper channels.

8. Implement cost control measures

Cost control is when you identify and minimise some expenses to increase your profit margins. As a small business owner, following cost control practices will help you improve profitability, increase your competitiveness, and help you scale your business sustainably. You can implement cost control measures by:

- Conducting a thorough cost analysis, to identify areas where you can reduce expenses. This can include reviewing expenses such as rent, utilities, supplies, and wages. For example, your business may be paying a lot more in rent. You could relocate to a cheaper location and save on rent expenses, which will help you increase your margins.

- Implementing cost-saving measures, in the form of negotiating better pricing with suppliers, austerity drives that encourage reducing energy usage, automating repetitive tasks, and outsourcing non-core functions.

- Continuous improvement, which involves collecting feedback from employees, customers, and suppliers, in addition to leveraging new technology and processes as needed.

- Performing earned value analysis at the project level. A project’s earned value (EV) indicates the work performed, expressed in terms of the approved budget. It helps you measure a project’s progress at any point in time, and it helps you estimate if your project will cost you more, less, or the same as your initial cost estimate.

If you take the difference between your EV and the actual value (AV) of work, you’ll obtain the cost variance which helps you estimate the project’s performance. If your project variance is negative, it means you’re overspending on it.

Why choose Caflou as your cost management software system?

A cost management system like Caflou will help you:

1. Manage all your business economics in one place

Manage your global and project-level budgets, track your cash inflows and outflows, automate your financial reporting, and monitor all your business costs in one place. Caflou is your end-to-end cost management solution.

2. Closely monitor resources and profitability

Need to determine which of your projects are most profitable, which employees are bringing in the most revenue, and your planned vs. actual costs for a project? Use insights from Caflou to calculate your projects’ profitability, your revenue per employee, and more.

3. Leverage analytics and historical data for better planning

Accurately forecast your financial needs and improve your cash flow planning with detailed historical data from your previous projects and contracts.

Transform your cost management today with Caflou. Get started for free.

<< Back to all articles in Caflou Business Management Academy