Based on the previous parts of the new series on corporate finance (Are you really making money? Take a look at your cash flow and Actively manage company’s cash flow), you were able to compile your financial overview of the income and use of money, broken down into operating, investment and financial cash flow, and also plan future cash flow using the appropriate software (for example CAFLOU). Today, we will take a closer look at the operating cash flow and how to manage it best.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

Financing of ordinary operation

The company’s operating activities include the purchase, storage and sale of goods, the purchase and storage of material and its transformation into semi-finished and finished products, their storage and sale, as well as the provision of services. To do this, you need space, equipment and manpower, sometimes also an operating loan. In terms of numbers, these are liabilities to suppliers of goods, materials and utilities, rents, liabilities to employees, the state, and financial institutions.

Liabilities have one essential feature. They have a given maturity. This means that the obligation to perform will occur at a pre-known moment in the future. Some liabilities are short-term, for example liabilities to employees are normally due with a delay of ten to twenty days (dependig on each country customs or laws). Other liabilities may be due over a longer period of time, for example liabilities arising from long-term loans will be repaid by the company over a number of years.

A financially sound company is able to pay its debts when they fall due. It is not economically correct to pay late or prematurely. Therefore, start with the time of expected payment of liabilities when planning and managing your operating cash flow.

Income in operating cash flow

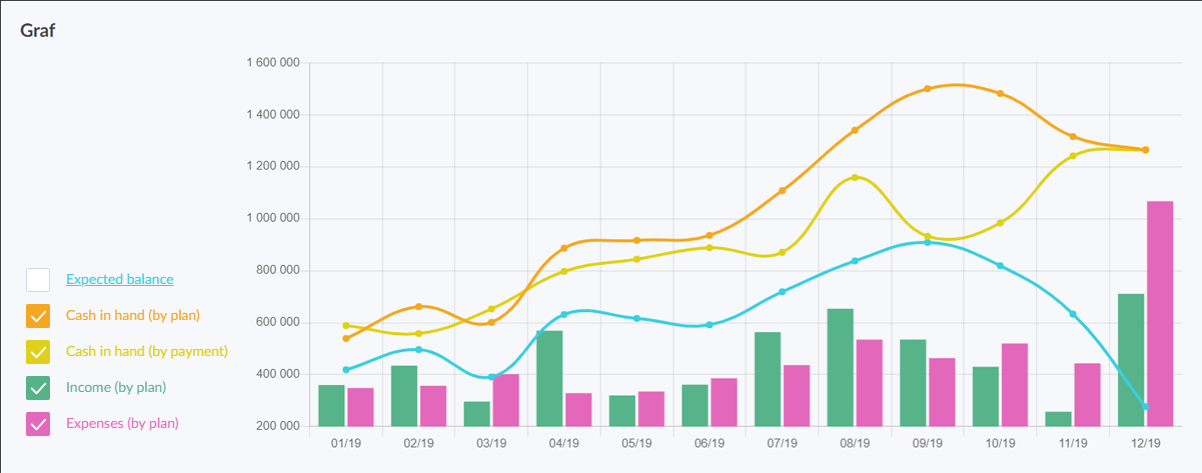

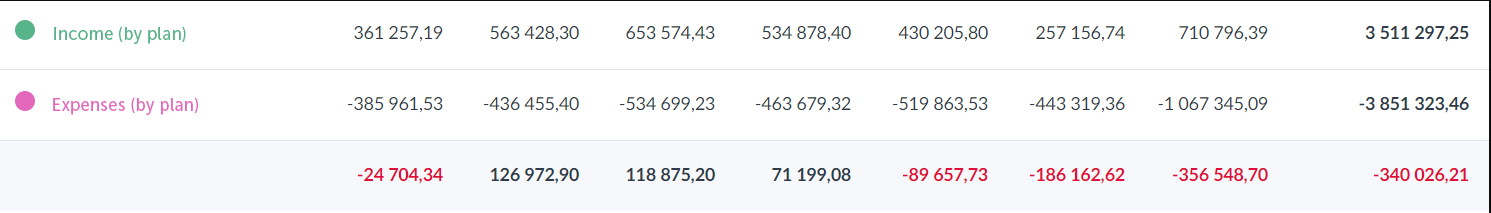

You can find out whether your operating income and expenses will be in line if you add the expected dates when the customers will pay for the goods, products or services which you have delivered to the cash flow plan as well. Unlike payments to your suppliers, employees, or the bank, you do not have full control over income from customers. Although you state the due date on the invoice, the actual payment is entirely in the hands of those who send you the payment from their bank accounts.

It is therefore worth considering whether to create a realistic plan based on payment dates on invoices and, at the same time, a pessimistic outlook with a postponement of money collection based on your experience with real payments from your customers. The result will be a more realistic picture of cash surpluses and deficits in the coming days or weeks. You can also categorize your income plan by income based on already contracted deliveries and expected income based on the sales outlook.

How to deal with surplus money

What can you do with excess cash? You can leave the money in a current account. This option is common, although the least economically efficient. What interest does a current company account offer? It most probably won’t even be units of percentage points to at least compensate for inflation. Thus, a certain decrease in the value of funds in current accounts certainly occurs over time.

However, economic efficiency is only one aspect of a company’s financial health. The second, no less important one, is financial stability. When there are many items to pay for in your plan of expenses in the near future, money that “has been waiting” in a company account for a few days will not lose much value.

What if there is a lack of money

However, if you see from the cash flow plan that a certain amount of money exceeds current expenses for the next few months, your cash flow statement makes it easier for you to decide whether to deposit the excess funds into a term account or buy tradable securities. If you do not have the heart of an investor, you can use free cash flow, for example, to support sales, for earlier payments at a lower price, etc.

If, on the other hand, the cash flow plan shows you that there is a risk of short-term deficits of financial resources due to the asynchronous development of income and expenses, then, again, you have several options.

For example, you can use a previously created nest egg, start negotiations with business partners and speed up income or delay expenses, or try to obtain external short-term resources. One way to stop the difference between income and expenses is to postpone purchases or seek resources by adjusting economic plans.

Learn to manage your working capital

Working capital can be understood as a financial injection necessary for the operation of the company and the maintenance of its sales. You can derive its amount from the value of money tied up by the inventory, receivables due within a year and money in the company’s account and the company’s treasury. When a business is thriving, sales grow. Increasing turnover causes growth in working capital. This will put pressure on operating financing. With higher sales volumes, the company has a higher value of receivables, and may also need larger inventory of materials, products or goods.

A decrease in sales can also cause an increased need for money, and it therefore has an impact on operating cash flow. The amount of the working capital will decrease, but the company will not be able, in most cases, to quickly adjust the amount of inventory to a lower level of sales. It is important to have timely information about the impacts on the cash flow development caused by changes in sales so that you can propose measures in time, use them to address impending insolvency by stabilizing cash flow and pay your liabilities in time.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.