Financial management without information about future income and expenses can be compared, with a little exaggeration, to walking blindfolded. If you don’t know what obstacle awaits you ahead, you cannot effectively decide on the next step. Due to unavailable or insufficient information about funds available in the future, you do not know to what extent your current decisions will affect the company’s ability to pay its future liabilities. A well-prepared cash flow plan will allow you to remove the imaginary blindfold from your eyes.

🎓 CAFLOU® cash flow academy is brought to you by CAFLOU® - 100% digital cash flow software

Different methods are used for determining cash flow predictions. However, you can prepare a good cash flow plan based on logic yourself without a deep knowledge of accounting. As companies make decisions with an impact on cash flow in the near and distant future, your financial plan should include both a short-term period of days and weeks and a long-term outlook determining the company’s needs for investments, payment of long-term credits or profit shares to associates. Therefore, supplement your considerations on the balance of funds, the collection of money from receivables and the payment of liabilities also with the outlook of planned investments and loans. The medium-term plan can then be utilized to monitor the use of operating loans, but also, for example, foreign currency movements.

Cash flow planning tools

Reliable cash flow planning is a source of competitive advantage. With the help of technologies, you can simplify many things in the company, from invoicing, through customer support, sharing documents with colleagues, to increasing the overall efficiency of company activities. A good information system will do a lot of work for you. It is necessary to plan not only the real development of cash flow, but also an estimate based on the considered future development. A division of the outlook into realistic, which includes already invoiced activities of the company, and probable on the basis of income from regularly invoiced activities, or future already known ad hoc orders, could be good for your orientation.

Reliable cash flow planning is a source of competitive advantage. With the help of technologies, you can simplify many things in the company, from invoicing, through customer support, sharing documents with colleagues, to increasing the overall efficiency of company activities. A good information system will do a lot of work for you. It is necessary to plan not only the real development of cash flow, but also an estimate based on the considered future development. A division of the outlook into realistic, which includes already invoiced activities of the company, and probable on the basis of income from regularly invoiced activities, or future already known ad hoc orders, could be good for your orientation.

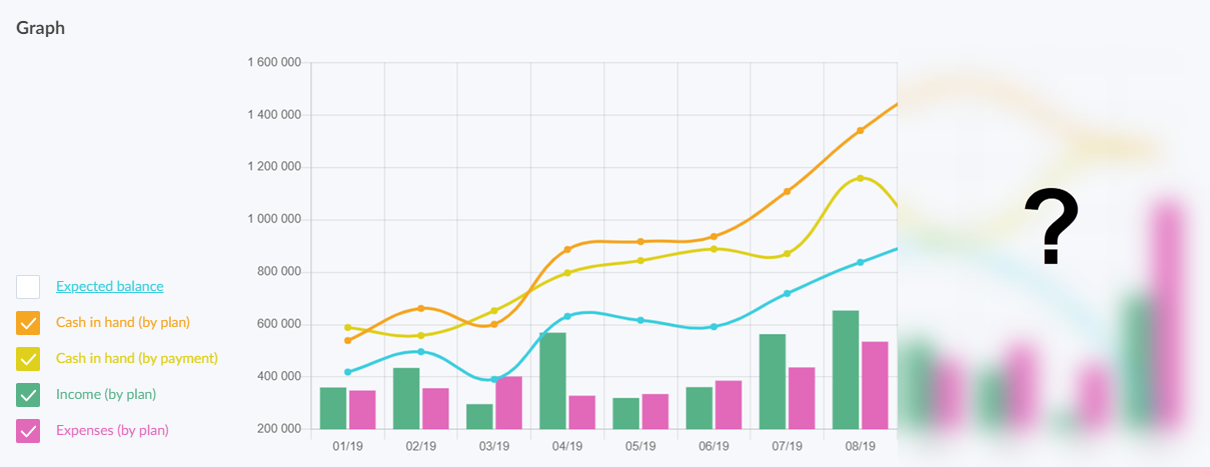

The preparation of financial plans is very difficult for many companies and often includes time-consuming calculations. Manual processing within a strategic financial plan is therefore not only laborious, but important connections can often be omitted. This leads to a reduction in the quality of the plan. The solution is cash flow management and planning software. You can plan cash flow in the CAFLOU smart application, for example. It allows you to see the income and expenses for each customer and supplier. You can also monitor cash flow according to projects, categories, sources of income and expenses or divided into actual and estimated cash flow.

💡 Do you know CAFLOU©? CAFLOU is a "light" business management system which can manage the performance and economy of your company and your team 100% digitally, and even remotely.

Quality preparation is essential

Having a good notion of past and current income and expenses is a good starting point. In order to effectively manage your company’s finances, you need to anticipate looming shortages of money before such a situation arises. The effort and time spent planning and managing cash flow is more than worth it. Thanks to a good cash flow plan, you can more easily monitor the payment of received invoices and other liabilities of the company at the time when they need to be paid. You can more effectively plan the development of the company and investments that will not get out of your hand due to lack of funds. Information on sufficient cash flow is also necessary when repaying credits and meeting bank conditions.

Substantial inputs are current bank account balances, receivables and payables. These sources can be understood as dynamic, because they are always updated when working with the cash flow result. Conventional accounting software can easily generate the data needed for cash flow modelling. Unlike dynamic inputs, static inputs need to be added to the model once and can be left in the system unchanged until significant changes occur. Such static inputs are, for example, payment schedule, monthly payment of wages, regular tax payments, social and health insurance contributions, but also planned investments.

Base it on the expected maturity dates of invoices, the payday and the date of rent payments, credit repayments and other expenses. Plan not only the probable development of cash flow, but also its pessimistic variant where not everything goes as planned. In situations where you don’t receive enough orders, the performance of the order is longer than expected, the delivery of material is delayed and that which is available from another supplier is more expensive, you are slowed down by machine downtime, etc., plan to pay only the necessary expenses. Is the cash flow still not positive? In advance, you can also think about deferring payments to those business partners who will understand and allow it.

Cash flow outlook according to the income statement

You can start with a plan of costs, revenues and economic results when planning cash flow. For the purposes of fulfilling the obligation to keep accounts, you undoubtedly have a profit and loss statement at your disposal. Your income statement can be a good basis for cash flow outlook, taking into account the differences between the world of accounting and the real world of money.

Company accounting does not primarily focus on income and expenses, but on costs and revenues. However, you can use this when planning cash flow. A plan based on your revenue and cost budget takes into account payment and collection time lags. For example, the labour cost for September will be paid in October. For the purposes of compiling the cash flow plan, it is appropriate to divide customers and suppliers according to the agreed invoice maturities.

At the beginning of the planned period in which you will generate revenues, revenues from the previous period are likely to be collected. Consider not only the initial balance of funds, but also the amount of receivables and similar short-term liabilities, which, in the given period, will represent collections and payments related to revenues and costs of the previous periods. Don’t forget to also add the considered purchases of fixed assets and credit payment schedules to your financial plan.

Operations, investment, financing

In the cash flow statement, classify cash flows according to the use of money, i.e. as the company’s operating, investment and financial activities. Think of them as individual floors. It is useful for financial management, but also for appreciating the economic condition of the company. Does the activity because of which you are in the market bring enough money? The answer is on the operating cash flow "floor". It is in the official statement, which you can generate in the pre-prepared reports of your accounting software. When the value of the operating cash flow is positive, income from sales of goods, products and services covers the company’s common expenses, from the purchase of materials, through the payment of wages and interests, to the income tax. It is information about whether the basic activities of the company are meaningful, i.e. whether they bring money to the company.

The imaginary second floor of cash flow is called investment cash flow. This "floor" is intended for the acquisition and sale of machines, production lines, cars, buildings, land, software and other fixed assets. This may also include income from profit shares in property-related companies or interests received from credits, loans and assistance to other companies, as these are also investments. In case of successful companies, investment cash flow is usually negative. It is a sign that the company wants to keep up with the competition in an ever-changing market environment and invests in the development and renewal of its assets.

Now, let’s ascend to the top floor of cash flow. The third area of income and expenses of the company is financial cash flow. Cash flow related to obtaining or returning business resources are recorded there. This means financial resources outside the normal activities of the company, such as those brought by owners and external creditors. In cash flow, this will result in the drawing or repayment of credits, the payment of financial leasing or the payment of profit shares to associates.

Take the risks into account

Market environment nowadays brings a number of risks that can significantly affect the achievement of planned results, be it financial risks, changes in exchange rates, commodity fluctuations, legislative changes or new technologies. Business owners and directors need to know what impact risks can have on a company’s economy. There is a solution in the form of a risk-based financial model.

Are you preparing for several scenarios in your cash flow plan? The time spent preparing an optimistic and pessimistic variant will pay off many times over thanks to the savings of the managed risks, which are associated with key areas of your activity, such as the volume of sales or the purchase price of basic inputs. To be able to estimate how much money you will need and for how long it will be needed with a high degree of probability, you need to find the potential risks of deviations from your cash flow plan.

For example, when selling abroad on a trade credit, the entrepreneur bears a number of risks based on the choice of the country to which the invoiced goods and products are delivered, risks associated with the choice of business partners to ensure transport, or currency risks associated with exchange rate fluctuations. You can manage the exchange rate risk, for example, by preparing a cash flow plan for all projects in foreign currencies and arranging the exchange rate after signing the contract. This proves useful especially when your primary currency strengthens; without arranging the exchange rate, the project would be damaged by a reduction in receipts in your primary currency if the exchange rate strengthened.

A frequent risk is also the potential threat to the fulfilment of the cash flow plan due to delays in payments of your major customers. To find possible causes of such behaviour of business partners, it is recommended to perform a financial analysis or a test of creditworthiness based on an estimate of the financial stability and performance of the company. The risk of late payments from customers, which are caused by their serious financial problems, can predict a high degree of threat to your cash flow. Therefore, actively request to hand over the goods in return for a deposit, or manage this risk otherwise. If, on the other hand, there would be a risk of a late payment from a financially sound customer, where the possible impacts are orders of lower magnitude, it would be enough to improve cash flow by regularly monitoring overdue receivables and setting an automatic reminder system.

<< Back to all articles in Caflou cash flow academy

Article author: Pavlina Vancurova, Ph.D. from ![]()

In cooperation with Pavlina Vancurova, Ph.D., specialist in business economics from consulting firm PADIA, we have prepared the Caflou cash flow academy for you, the aim of which is to help you expand your knowledge in the field of cash flow management in small and medium-sized companies.

In her practice, Pavlina provides economic advice in the area of financial management and setting up controlling in companies of various fields and sizes. In 2011, she co-founded the consulting company PADIA, where she works as a trainer and interim financial director for a number of clients. She also draws on her experience as the executive director of an international consulting firm. She worked as a university teacher and is the author of a number of professional publications.